Artificial Blood Market Size and Forecast – 2026 – 2033

The Global Artificial Blood Market size is estimated to be valued at USD 2.1 billion in 2026 and is expected to reach USD 4.5 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 11.3% from 2026 to 2033.

Global Artificial Blood Market Overview

Artificial blood products are oxygen-carrying substitutes designed to mimic the function of natural blood. These products include hemoglobin-based oxygen carriers and perfluorocarbon emulsions. Artificial blood is used in trauma care, surgery, and emergency situations where donor blood is unavailable or incompatible. The products aim to transport oxygen efficiently while minimizing immune reactions and infection risk. Stability, oxygen delivery capacity, and biocompatibility are key characteristics of artificial blood products.

Key Takeaways

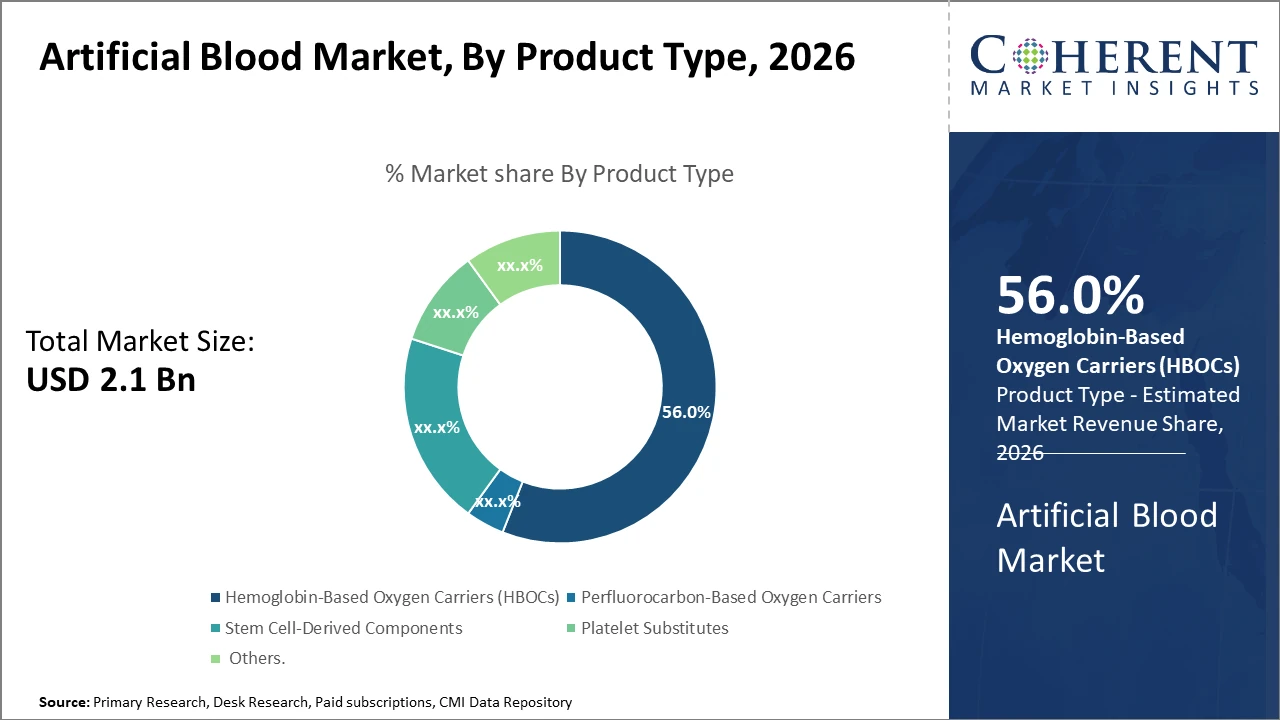

Hemoglobin-Based Oxygen Carriers dominate the product type segment, representing over 56% of the market share, driven by proven clinical efficacy and scalable manufacturing

Emergency medicine leads the application segment, accounting for more than 40% of usage, due to high demand in trauma and critical care situations

Hospitals remain the largest end-user segment, capturing nearly 52% market revenue through integration in transfusion protocols

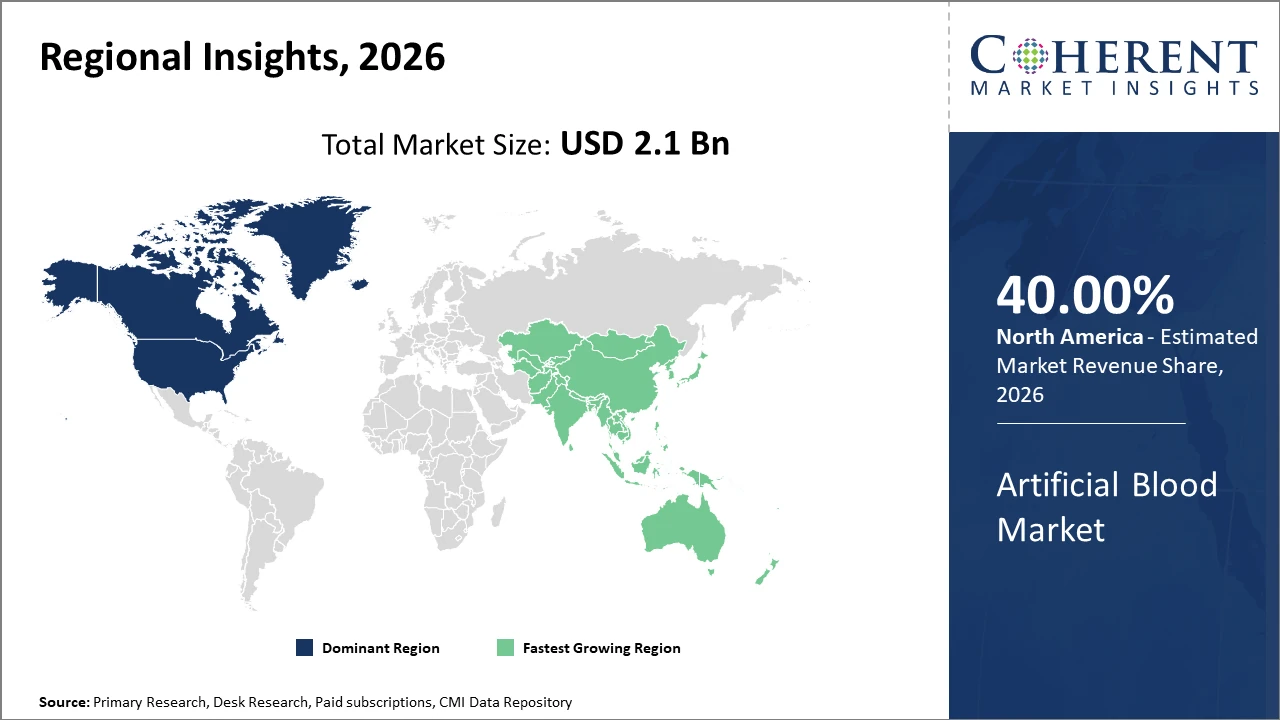

North America holds the largest market share, attributed to robust healthcare infrastructure and early adoption of innovative artificial blood products

Asia Pacific exhibits the fastest CAGR, propelled by increasing healthcare expenditure, government support, and unmet demand for blood substitutes in populous countries like China and India

Artificial Blood Market Segmentation Analysis

To learn more about this report, Download Free Sample

Artificial Blood Market Insights, By Product Type

Hemoglobin-based oxygen Carriers dominate the market share. HBOCs hold a commanding position owing to their demonstrated clinical efficacy, scalable production techniques, and approvals in multiple countries, making them the backbone of the market. The fastest-growing subsegment is Stem Cell-Derived Components, which are gaining traction due to their potential for personalized therapy and improved oxygen delivery capabilities in clinical trials. Perfluorocarbon-Based Oxygen Carriers remain relevant for niche applications, especially in surgical blood substitutes, while Platelet Substitutes and Others cater to specialized needs such as thrombocytopenia management and research applications, respectively.

Artificial Blood Market Insights, By Application

Emergency Medicine dominates the market share, driven by critical trauma interventions and battlefield medicine, where rapid oxygen delivery is vital. The next fastest-growing segment is Chronic Anemia Management, reflecting expanding use of artificial blood in long-term therapies for diseases like sickle cell anemia and thalassemia. Surgical Transfusions maintain steady growth, supported by rising surgical procedure volumes globally. Organ Transplantation is an emerging application with promising prospects due to artificial blood’s role in organ preservation and immune modulation. Others encompass clinical research and veterinary applications, contributing to market diversity.

Artificial Blood Market Insights, By End-User

Hospitals dominate significantly, given their high volume of blood transfusions and adoption of advanced artificial blood substitutes to mitigate donor shortages, accounting for the largest market share. Trauma Centers are the fastest-growing subsegment due to intensive use in emergency scenarios requiring immediate oxygen delivery, supported by rising trauma incidence rates globally. Ambulatory Care Centers and Blood Banks are gradually expanding their artificial blood utilization, focusing on outpatient and storage applications. Research Institutes continue to contribute substantially through extensive clinical trials and innovation in artificial blood technologies.

Artificial Blood Market Trends

The market trend is characterized by the accelerated development of next-generation oxygen carriers focused on improving patient outcomes through enhanced biocompatibility and effective oxygen delivery.

For example, in 2025, a leading North American player introduced a stem cell-derived blood substitute, marking a technological milestone.

The increasing endorsement of artificial blood in trauma and military medicine exhibits substantial procurement growth, as seen from defense contracts awarded in 2024.

Additionally, regulatory harmonization and streamlined clinical trial processes in Europe and North America have led to faster product approvals, propelling market growth.

Artificial Blood Market Insights, By Geography

To learn more about this report, Download Free Sample

North America Artificial Blood Market Analysis and Trends

In North America, the dominance in the Artificial Blood market is underscored by the presence of advanced healthcare facilities, significant investments in biotechnology research, and favorable regulatory frameworks that facilitate expedited product approvals. This region accounts for approximately 40% of the market share, supported by widespread adoption in critical care and trauma centers. Notably, the U.S. Department of Defense’s commitment to developing artificial blood solutions for battlefield scenarios has substantially catalyzed market revenue.

Asia Pacific Artificial Blood Market Analysis and Trends

Meanwhile, Asia Pacific exhibits the fastest growth with a CAGR exceeding 14%, driven by rapid healthcare infrastructure development, increasing government funding, and growing prevalence of chronic diseases requiring alternative transfusion solutions. Expanding clinical trials and rising awareness programs across China and India are key factors fueling this growth. Multinational companies have intensified their market penetration strategies by localizing manufacturing, which further accelerates business growth in this region.

Artificial Blood Market Outlook for Key Countries

USA Artificial Blood Market Analysis and Trends

The USA’s artificial blood market continues to thrive on ongoing research investments and supportive regulatory mechanisms. In 2024, the FDA granted breakthrough therapy designation to two novel hemoglobin-based products, significantly expediting their commercialization. U.S.-based market companies consistently spearhead innovation, leveraging advanced bioengineering techniques that supplement healthcare delivery in trauma units and surgical care. Consequently, these developments position the USA as a prime contributor to global market revenue and technological leadership.

China Artificial Blood Market Analysis and Trends

China’s market is propelled by expanding healthcare access and increased government focus on biotechnology innovation. Recent initiatives promoting alternative therapies due to donor blood shortages have led to a 30% rise in clinical trial activity involving artificial blood substitutes in 2025. Local manufacturers and multinational companies collaborate through joint ventures, optimizing supply chains and product affordability. These efforts help solidify China’s impact as a key regional growth driver within the Asia Pacific market ecosystem.

Analyst Opinion

The surging demand for blood substitutes in emergency medicine and surgical applications has resulted in a significant increase in production capacity. Recent data from 2024 reveals that production lines expanded by over 18% globally, particularly in regions with limited donor availability. This supply-side growth is pivotal to fulfilling unmet clinical needs and is directly linked to the increase in market share for artificial blood products.

Pricing strategies for artificial blood products have witnessed considerable refinement, with manufacturers optimizing costs to balance affordability and therapeutic efficacy. For instance, industry data from 2025 shows a 7% average price reduction compared to 2023 levels, enhancing market penetration across emerging economies. Demand-side dynamics, such as growing hospital adoption rates, have paralleled this trend, with artificial blood usage in transfusion protocols increasing by 25% in North America in recent years.

The expansion of artificial blood use cases across various industries, including trauma care, oncology, and organ transplantation, has driven market growth. A case in point is the trial conducted by a leading trauma center in 2024, where artificial blood reduced transfusion-related complications by 15%, substantiating clinical benefits that justify wider adoption. Micro-indicators such as rising clinical trial registrations in Asia-Pacific markets further indicate accelerating demand from healthcare systems globally.

Export volumes of artificial blood products surged notably in 2024-2025, with Asia-Pacific emerging as a key export destination due to its expanding healthcare infrastructure. Export statistics reflect a 22% increase in manufactured artificial blood units dispatched to these regions compared to the prior year, underpinning the global expansion of supply networks and bolstering the market forecast.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2026: | USD 2.1 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2026 To 2033 |

| Forecast Period 2026 to 2033 CAGR: | 11.3% | 2033 Value Projection: | USD 4.5 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | Terumo Corporation, Haemocom, Hemanext Inc., PolyHeme Inc., Acelity L.P. Inc., Grifols S.A., RedMed Technologies, SELEXSI, Fresenius Kabi AG, LipoMed Inc. | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Artificial Blood Market Growth Factors

The market growth is primarily driven by the urgent need to address blood scarcity across healthcare systems due to rising surgical procedures and trauma cases. The increasing prevalence of chronic diseases, such as sickle cell anemia and hemophilia, is elevating demand for artificial blood as a reliable alternative to donor transfusions. Technological advancements, including novel hemoglobin-based carriers and stem cell-derived formulations, are expanding the therapeutic scope and improving safety profiles. Additionally, government initiatives promoting blood safety and innovative healthcare infrastructure developments, especially in the Asia-Pacific region, are further accelerating market expansion. For instance, regulatory approvals granted in 2024 for third-generation oxygen carriers have opened new commercial avenues, underpinning sustained market growth.

Artificial Blood Market Development

In June 2025, Japan announced the launch of universal artificial blood, a major medical breakthrough designed to be compatible with all blood types. The innovation aims to address chronic blood shortages, enable rapid transfusions in emergency and disaster settings, and reduce reliance on donor blood, with the potential to significantly transform trauma care and global transfusion practices.

In April 2025, an Indian American–led research team was awarded a USD 2.7 million grant to accelerate the development of synthetic blood. The funding supports advanced research focused on improving oxygen-carrying capacity, storage stability, and safety, reinforcing global efforts to create scalable, lab-engineered blood alternatives for clinical use.

Key Players

Leading Companies of the Market

Haemocom

Hemanext Inc.

PolyHeme Inc.

Acelity L.P. Inc.

Grifols S.A.

RedMed Technologies

SELEXSI

Fresenius Kabi AG

LipoMed Inc.

Several leading market companies have adopted competitive strategies such as strategic partnerships and licensing agreements to enhance their product pipeline and accelerate go-to-market timelines. For example, in 2024, Hemarina entered a co-development deal with a major OEM, resulting in a 30% reduction in R&D cycle time. Meanwhile, Biopure’s targeted acquisition of niche technology entities enhanced its patented product portfolio, contributing to a 12% increase in market revenue in 2025.

Artificial Blood Market Future Outlook

The future outlook for the artificial blood market is cautiously optimistic as technology advances address earlier limitations. Innovations in oxygen carrier design and biocompatibility may improve safety profiles. Demand will be driven by emergency medicine, military applications, and regions with limited blood supply. Regulatory progress and clinical validation will be critical. As solutions mature, artificial blood could play a complementary role alongside traditional transfusion systems.

Artificial Blood Market Historical Analysis

The artificial blood market originated from the need to address blood shortages and transfusion risks. Early research focused on hemoglobin-based oxygen carriers but faced challenges related to safety and efficacy. Over time, advances in chemistry and biotechnology improved formulation stability and oxygen delivery. Clinical trials explored use in trauma care and surgery. Despite setbacks, continued research sustained interest. The market remained niche due to regulatory and technical hurdles.

Sources

Primary Research Interviews:

Trauma Surgeons

Hematologists

Biomedical Scientists

Emergency Physicians

Defense Medical Officers

Databases:

NIH Blood Research Data

PubMed

FDA Blood Products Database

Magazines:

Medical Device Network

BioPharma Dive

Drug Discovery Today

MedTech Insight

Healthcare Innovation

Journals:

Transfusion Journal

Artificial Cells

Nanomedicine and Biotechnology

Blood Journal

Journal of Trauma Care

Biomaterials

Newspapers:

Reuters Health

Wall Street Journal (Biotech),

Financial Times (Pharma)

Guardian (Health)

New York Times (Science)

Associations:

American Association of Blood Banks

International Society of Blood Transfusion

Biomedical Engineering Society

World Health Organization

International Society for Artificial Organs

Share

Share

About Author

Abhijeet Kale is a results-driven management consultant with five years of specialized experience in the biotech and clinical diagnostics sectors. With a strong background in scientific research and business strategy, Abhijeet helps organizations identify potential revenue pockets, and in turn helping clients with market entry strategies. He assists clients in developing robust strategies for navigating FDA and EMA requirements.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients