Antidiabetic Biosimilars Market Size and Forecast – 2026 – 2033

The Global Antidiabetic Biosimilars Market size is estimated to be valued at USD 5.8 billion in 2026 and is expected to reach USD 13.4 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 12.5% from 2026 to 2033.

Global Antidiabetic Biosimilars Market Overview

The antidiabetic biosimilars market is expanding steadily due to the rising global prevalence of diabetes and the growing demand for cost-effective biologic therapies. Biosimilars of insulin and other antidiabetic biologics offer comparable efficacy and safety to reference products while reducing treatment costs and improving patient access. Market growth is supported by patent expirations of major biologics, favorable regulatory pathways, and increasing healthcare expenditure in emerging economies. Key players are investing in product development and global approvals. However, challenges such as regulatory complexity, physician acceptance, and manufacturing costs continue to influence market adoption.

Key Takeaways

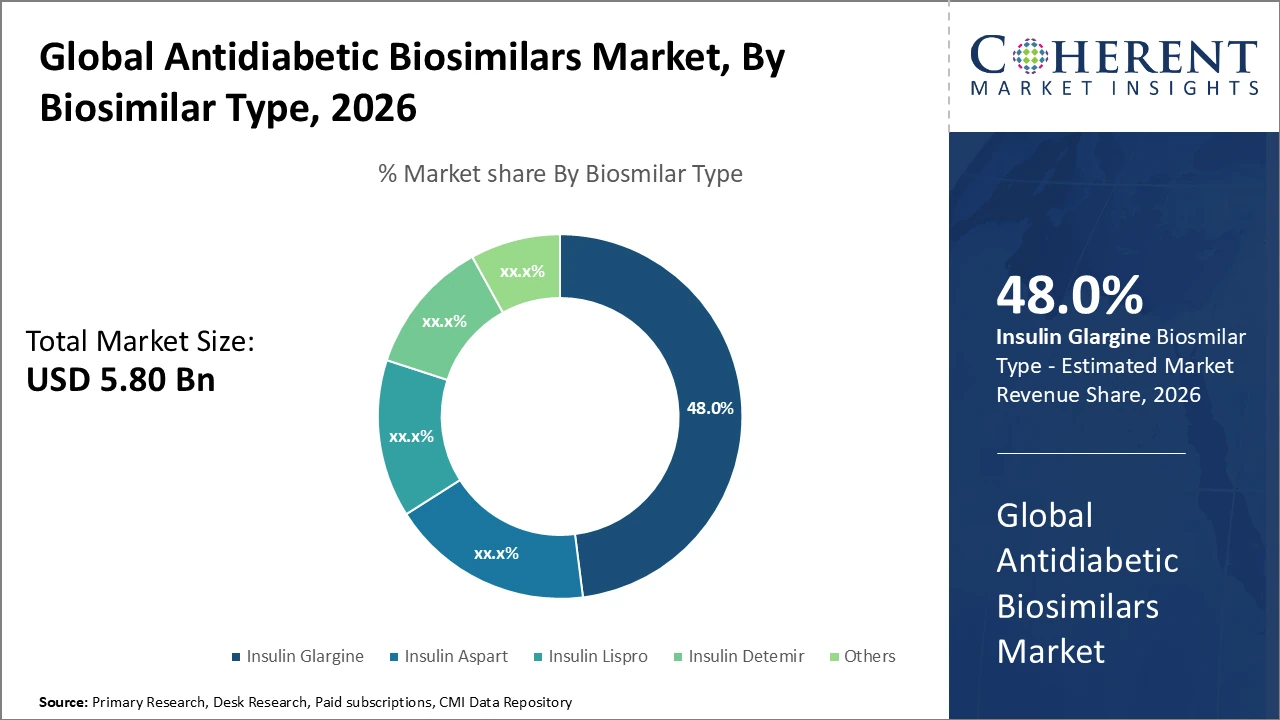

Insulin Glargine subsegment holds the largest revenue share at 48%, driven by widespread clinical adoption and the availability of multiple biosimilars supporting market expansion.

Type 2 Diabetes applications represent the fastest-growing segment, fueled by increasing disease prevalence and continuous advancements in treatment options.

Hospital Pharmacy remains the dominant distribution channel, ensuring consistent revenue generation and broad patient access.

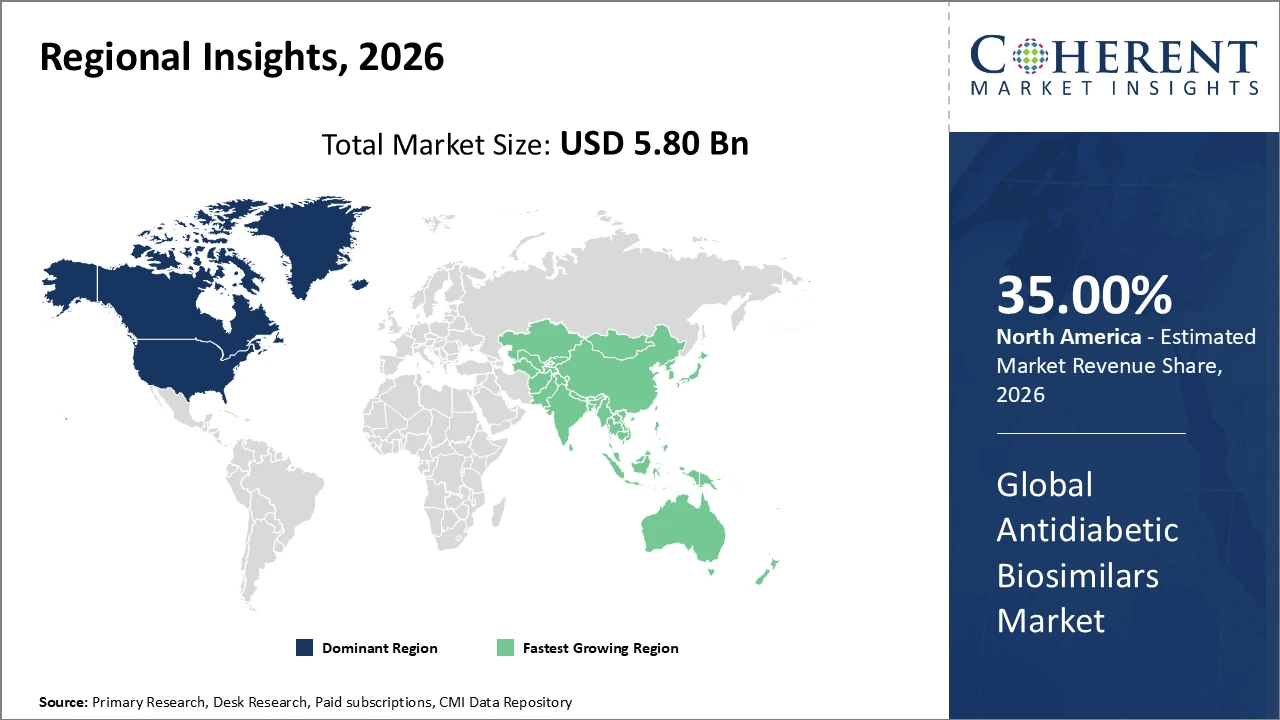

North America leads the market with over 35% share, supported by a strong industry presence and favorable reimbursement frameworks.

Asia Pacific is the fastest-growing region, registering a CAGR above 14%, driven by rising diabetic populations and improving healthcare infrastructure.

Europe demonstrates stable growth, benefiting from a mature market, sustained demand, and regulatory harmonization.

Antidiabetic Biosimilars Market Segmentation Analysis

To learn more about this report, Download Free Sample

Antidiabetic Biosimilars Market Insights, By Biosimilar Type

Insulin Glargine dominates the market share due to its extensive clinical use and the wide availability of biosimilar options globally. It is preferred for its basal insulin properties, providing consistent and long-acting glucose control for diabetic patients. Insulin Aspart represents the fastest-growing subsegment, driven by strong prandial glucose control and increasing adoption in combination therapies for both Type 1 and Type 2 diabetes. Insulin Lispro, Insulin Detemir, and other biosimilars account for smaller market shares but play an important role by offering flexible dosing options, targeted therapeutic benefits, and improved patient adherence.

Antidiabetic Biosimilars Market Insights, By Application

Type 2 Diabetes exhibits the fastest growth due to the rising global diabetic population and evolving treatment protocols that increasingly favor biosimilars. This segment benefits from expanded screening programs and early intervention strategies, reinforcing its leading contribution to market revenue. Type 1 Diabetes holds a stable but smaller market share, with biosimilars primarily addressing long-term insulin dependency. The Others segment, which includes gestational diabetes and less prevalent diabetic conditions, presents limited yet steady growth opportunities for market participants.

Antidiabetic Biosimilars Market Insights, By End-User

Hospital Pharmacy leads the market in revenue due to centralized procurement systems and prescription dominance within controlled healthcare settings. It ensures reliable availability of biosimilars for both inpatient and outpatient care. Online Pharmacy is the fastest-growing subsegment, driven by the expansion of telehealth services and increasing consumer preference for home delivery, particularly following post-2024 pandemic adaptations. Retail Pharmacy continues to hold a significant but traditional role by offering convenient access in urban and semi-urban areas. The Others segment includes specialty pharmacies and institutional sales channels, providing additional and complementary market reach.

Antidiabetic Biosimilars Market Trends

Increasing penetration of biosimilars in chronic disease management is reshaping market dynamics by improving treatment affordability and cost efficiency.

Accelerated approvals of biosimilar insulin in 2024 across emerging markets such as Brazil and India have significantly expanded patient access.

Growing sustainability concerns are prompting manufacturers to optimize biosynthesis processes, with reports in 2025 indicating up to a 20% reduction in carbon emissions during development phases.

Integration of digital health solutions with biosimilar therapies is gaining momentum, as telemedicine platforms support wider biosimilar adoption in remote and underserved regions.

These trends collectively reflect an evolving market landscape driven by accessibility, sustainability, and healthcare digitization.

Antidiabetic Biosimilars Market Insights, By Geography

To learn more about this report, Download Free Sample

North America Antidiabetic Biosimilars Market Analysis and Trends

North America’s leadership in the antidiabetic biosimilars market is driven by its advanced healthcare infrastructure, well-established reimbursement systems, and a large diabetic population seeking affordable treatment options. The United States alone accounts for over 25% of the global market, supported by strong participation from major companies such as Novo Nordisk and Eli Lilly, whose biosimilar launches have reduced insulin therapy costs by up to 30%. Continued investment in research and development, along with favorable FDA policies that streamline biosimilar approvals, further strengthens North America’s dominant position and sustained market growth.

Asia Pacific Antidiabetic Biosimilars Market Analysis and Trends

Meanwhile, the Asia Pacific region demonstrates the fastest growth in the antidiabetic biosimilars market, driven by expanding healthcare access, increasing diabetes prevalence, and stronger government support for biosimilar adoption. The region is projected to register a CAGR exceeding 14%, with India and China leading growth due to large patient populations and rising health awareness. Regional players such as Biocon and Dr. Reddy’s Laboratories play a critical role by leveraging cost-efficient manufacturing capabilities and benefiting from evolving regulatory frameworks, positioning Asia Pacific as a key growth hub within emerging markets.

Antidiabetic Biosimilars Market Outlook for Key Countries

USA Antidiabetic Biosimilars Market Analysis and Trends

The U.S. market is highly significant due to its high diabetes prevalence and an advanced healthcare reimbursement system that promotes biosimilar adoption. Since 2024, the launch of multiple biosimilar insulin analogs by companies like Sanofi and Mylan has expanded treatment options and significantly reduced therapy costs. Favorable FDA policies have accelerated biosimilar approvals, fostering competition and innovation in the market. Furthermore, strategic collaborations between domestic manufacturers and international partners have optimized supply chains, enhancing market revenue and supporting long-term growth strategies.

Germany Antidiabetic Biosimilars Market Analysis and Trends

Germany’s antidiabetic biosimilars market is characterized by steady growth, driven by a mature healthcare system, strong regulatory support, and growing cost-containment initiatives. Biosimilars, particularly insulin analogs, are increasingly adopted to reduce treatment expenses while maintaining therapeutic efficacy. Reimbursement policies and early biosimilar substitution programs encourage physician and patient uptake. Market expansion is supported by established pharmaceutical players launching competitive biosimilar portfolios and ongoing R&D investments. Hospital and retail pharmacies remain key distribution channels. Sustainability initiatives and digital health integration, including telemedicine for diabetes management, are gradually influencing market dynamics, positioning Germany as a stable yet innovative biosimilar market in Europe.

Analyst Opinion

The rising incidence of diabetes in Asia Pacific and North America has strongly influenced demand, with India and China reporting a combined 18% increase in diagnosed cases between 2024 and 2026, driving higher imports and local manufacturing to meet therapeutic needs and boosting market revenue.

Advancements in recombinant DNA technology and streamlined biosimilar approval processes have improved production efficiency. Biosimilar insulin analogs saw a 28% global increase in production capacity in 2025, enabling competitive pricing and expanding market share.

Greater adoption of biosimilars in hospital formularies and reimbursement schemes reflects evolving market dynamics. EU nations recorded a 24% increase in biosimilar inclusion in national reimbursement lists during 2024, improving accessibility and enabling new therapeutic applications.

Pricing pressures from patent expirations of leading biologics have accelerated market penetration. In the U.S., multiple biosimilar insulin glargine launches since late 2024 reduced prices by an average of 35%, signaling a shift in growth strategies and industry trends supporting sustained expansion.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2026: |

USD 5.8 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2026 To 2033 |

| Forecast Period 2026 to 2033 CAGR: | 12.5% | 2033 Value Projection: | USD 13.4 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | Novo Nordisk, Biocon, Sanofi, Eli Lilly, Pfizer, Sandoz, Dr. Reddy’s Laboratories, Samsung Bioepis, Wockhardt, Zydus Cadila | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Antidiabetic Biosimilars Market Growth Factors

The growing global diabetic population, particularly in emerging economies, serves as a key driver of antidiabetic biosimilars market growth. Increased affordability, fueled by biosimilar production efficiencies and patent expirations of reference biologics, has broadened access beyond urban centers. Technological advancements in biologics manufacturing, combined with regulatory harmonization, have lowered market entry barriers, enabling manufacturers to scale operations rapidly. Additionally, expanded government reimbursement programs and improvements in healthcare infrastructure, especially across Asia-Pacific, have accelerated biosimilar adoption. These factors collectively reinforce strong market growth dynamics, supporting higher revenue generation, wider patient accessibility, and sustained expansion across both developed and emerging regions.

Antidiabetic Biosimilars Market Development

In early **2025 the U.S. Food and Drug Administration approved Merilog (insulin-aspart-szjj), the first rapid-acting insulin biosimilar to NovoLog, marking a key advancement in antidiabetic biosimilars by broadening insulin treatment options and potentially lowering costs for people with diabetes as competition increases in the insulin market. This builds on regulatory momentum in biosimilars that aims to improve access to affordable biologic therapies.

Another important development is China’s first locally developed biosimilar version of Ozempic (semaglutide), with a Chinese drugmaker applying for approval for its semaglutide biosimilar. If approved, this product would be the first semaglutide biosimilar in Mainland China, reflecting growing global efforts to introduce more accessible GLP-1 therapies for type-2 diabetes as major biologics approach patent expiry.

Key Players

Leading Companies of the Market

Novo Nordisk

Sanofi

Biocon

Eli Lilly

Pfizer

Sandoz

Dr. Reddy’s Laboratories

Samsung Bioepis

Wockhardt

Zydus Cadila

Several market players have pursued aggressive growth strategies, including capacity expansion and strategic partnerships. For instance, Biocon’s collaboration with leading global pharmaceutical companies in 2025 led to a 30% increase in biosimilar insulin production capacity, expanding its market reach. Likewise, Sanofi’s investment in digital supply chain solutions reduced lead times by 15%, enhancing operational efficiency and strengthening its competitive position in the market. These initiatives reflect a broader trend of leveraging collaborations and technology to optimize production, improve accessibility, and sustain growth in the antidiabetic biosimilars market.

Antidiabetic Biosimilars Market Future Outlook

The antidiabetic biosimilars market is poised for robust growth, driven by rising diabetes prevalence, increasing healthcare expenditure, and the push for cost-effective treatment options. Ongoing patent expirations of major insulin and biologic therapies will continue to open opportunities for new biosimilar entrants. Advances in manufacturing technologies, regulatory harmonization, and digital health integration are expected to streamline production and enhance patient access, particularly in emerging markets. Hospitals, online pharmacies, and government-supported reimbursement programs will remain key distribution channels. Overall, the market outlook is positive, with sustained expansion, greater affordability, and wider adoption of biosimilars shaping the future of diabetes management globally.

Antidiabetic Biosimilars Market Historical Analysis

The antidiabetic biosimilars market has experienced steady growth over the past decade, largely driven by the rising global prevalence of diabetes and the high cost of reference biologics. Initially, market expansion was concentrated in developed regions like North America and Europe, where advanced healthcare infrastructure, strong regulatory frameworks, and reimbursement policies facilitated biosimilar adoption. Early biosimilar insulin launches helped reduce therapy costs and increase patient access. In emerging markets, growth was slower due to limited healthcare access and regulatory complexities, but increasing awareness and government initiatives gradually improved adoption. Overall, historical trends reflect a shift toward cost-effective, accessible diabetes management solutions.

Sources

Primary Research Interviews:

Endocrinologists and diabetologists

Hospital Pharmacists

Clinical researchers in biologics and biosimilars

Pharmaceutical company executives

Databases:

World Health Organization (WHO) Global Health Observatory

International Diabetes Federation (IDF) Diabetes Atlas

OECD Health Data

Magazines:

PharmaTimes

Pharmaceutical Technology

Biosimilar Development

Pharmaceutical Executive

FiercePharma

Journals:

Diabetes Care

BioDrugs

Diabetes, Obesity and Metabolism

Journal of Diabetes Science and Technology

Therapeutic Advances in Endocrinology and Metabolism

Newspapers:

The New York Times (Health)

The Guardian (Health)

Financial Times (Healthcare)

The Hindu (Health)

Reuters Health

Associations:

World Health Organization (WHO)

International Diabetes Federation (IDF)

European Medicines Agency (EMA)

Biosimilar Medicines Group (BMG)

Share

Share

About Author

Ghanshyam Shrivastava - With over 20 years of experience in the management consulting and research, Ghanshyam Shrivastava serves as a Principal Consultant, bringing extensive expertise in biologics and biosimilars. His primary expertise lies in areas such as market entry and expansion strategy, competitive intelligence, and strategic transformation across diversified portfolio of various drugs used for different therapeutic category and APIs. He excels at identifying key challenges faced by clients and providing robust solutions to enhance their strategic decision-making capabilities. His comprehensive understanding of the market ensures valuable contributions to research reports and business decisions.

Ghanshyam is a sought-after speaker at industry conferences and contributes to various publications on pharma industry.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients