Anionic Surfactants Market Size and Forecast – 2026 – 2033

In 2026, the Global Anionic Surfactants Market size is estimated to be valued at USD 18.7 billion and is expected to reach USD 29.3 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 6.5% from 2026 to 2033.

Global Anionic Surfactants Market Overview

Anionic surfactants are surface-active agents that carry a negative charge when dissolved in water. These products are widely used for their excellent cleansing, foaming, and emulsifying properties. Common types include alkyl sulfates, alkyl ether sulfates, and sulfonates. Anionic surfactants are key ingredients in household detergents, laundry powders, dishwashing liquids, shampoos, and industrial cleaners. Their effectiveness in removing oils and dirt makes them essential in cleaning and personal care formulations.

Key Takeaways

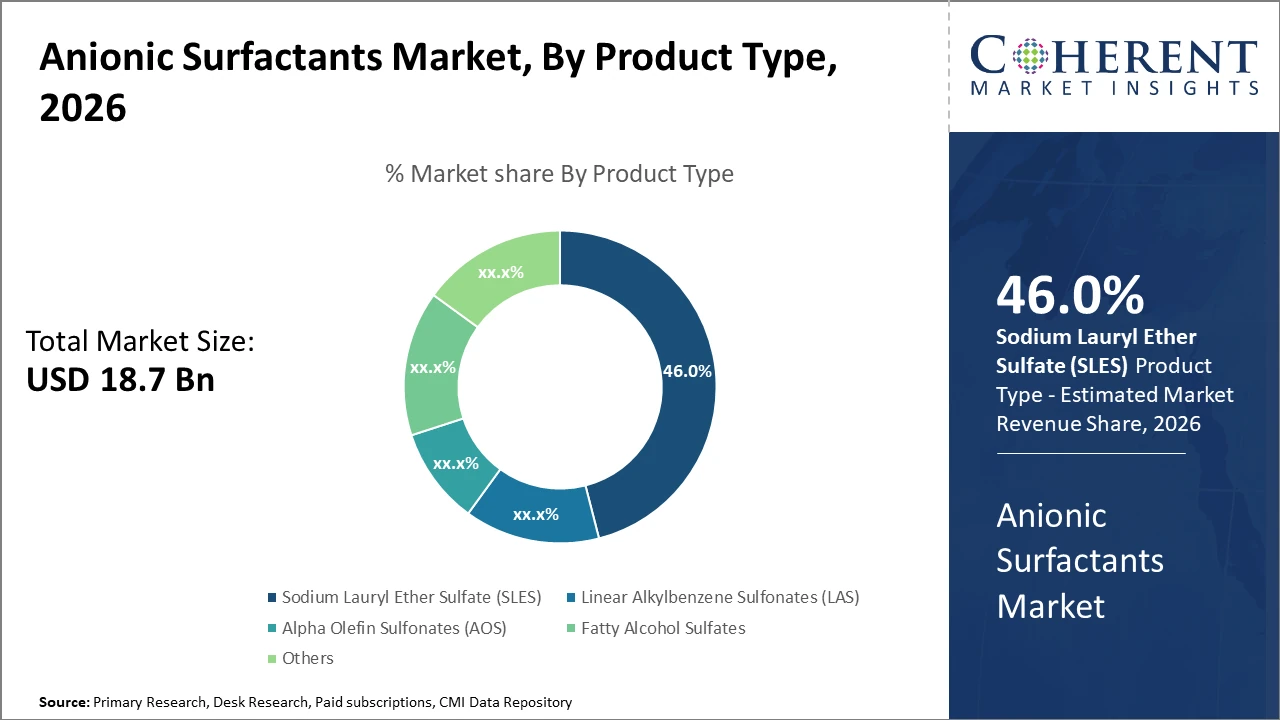

The Sodium Lauryl Ether Sulfate (SLES) subsegment holds significant prominence within the product segment, maintaining nearly 46% market share, reinforced by its diverse application across household and personal care sectors.

The household cleaning application segment dominates industry size, driven by heightened hygiene consciousness and demand for high-performance detergents.

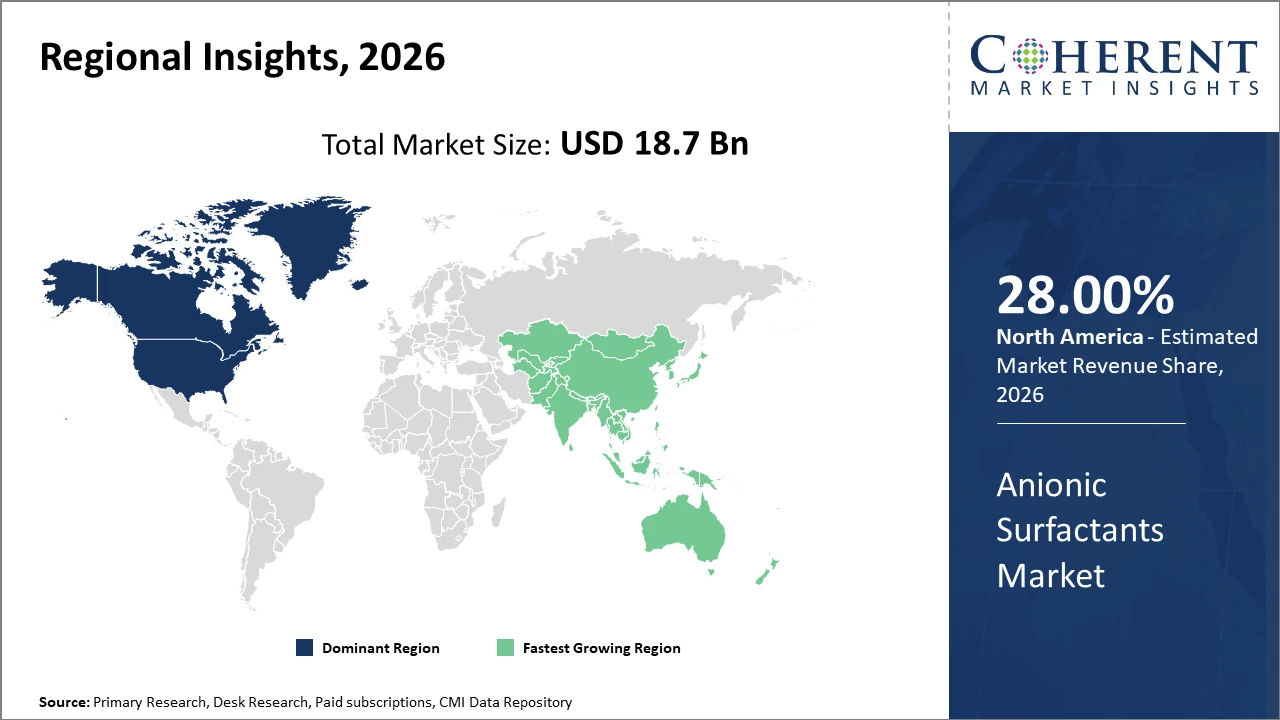

North America leads regional industry share with over 28% of the market size, supported by stringent environmental regulations and advanced manufacturing infrastructure.

Asia Pacific showcases the fastest growth trajectory with a CAGR above 7%, propelled by expanding industrial sectors and increasing consumer spending power in countries like India and China.

Anionic Surfactants Market Segmentation Analysis

To learn more about this report, Download Free Sample

Anionic Surfactants Market Insights, By Product Type

SLES dominates the market share with nearly 46%, attributed to its widespread use in household detergents and personal care due to compatibility and cost-effectiveness. The fastest growing segment is Alpha Olefin Sulfonates (AOS), gaining traction because of its superior skin compatibility and biodegradable nature, particularly in premium personal care formulations. LAS remains a staple in industrial and household cleaning, valued for strong detergency, whereas Fatty Alcohol Sulfates cater mainly to niche cosmetic applications.

Anionic Surfactants Market Insights, By Application

Household Cleaning leads the market share due to sustained growth in demand for effective and sustainable cleaning solutions, backed by increased hygiene awareness globally. Personal care is the fastest-growing application segment, driven by rising consumer inclination towards sulfate-free and sensitive skin formulations. Industrial & Institutional Cleaning maintains a steady demand due to requirements in the manufacturing and oil extraction sectors. Oilfield Chemicals represent a smaller but technologically important segment, while Others include specialized applications in agriculture and textiles.

Anionic Surfactants Market Insights, By Form

The Anionic Surfactants market by form includes Powder, Liquid, Paste, and Others. Liquid surfactants dominate market share due to easy formulation in detergents and cleaning products, constituting the preferred choice for both industrial and consumer segments. The fastest-growing subsegment is Powders, experiencing rapid adoption in emerging markets because of higher shelf life and lower transportation costs. Paste forms, though niche, are favored in specialty industrial applications due to handling efficiency.

Anionic Surfactants Market Trends

Recent market trends depict a significant shift towards bio-based anionic surfactants, with industry leaders increasing the share of renewable raw materials by nearly 20% in 2024 compared to 2022.

This shift is largely motivated by stringent global regulations and consumer preference towards sustainability.

Concentrated surfactant formulations also gain traction, reducing logistics costs and environmental footprints, a trend exemplified by leading producers cutting packaging weight by over 15%.

Furthermore, Asia Pacific's surge in urbanization, coupled with governmental support for chemical manufacturing infrastructure, has transformed it into a hotspot for demand growth and innovation.

Anionic Surfactants Market Insights, By Geography

To learn more about this report, Download Free Sample

North America Anionic Surfactants Market Analysis and Trends

In North America, the dominance in the Anionic Surfactants Market is driven by a well-established industrial base, advanced manufacturing technologies, and stringent eco-compliance standards. The region contributes approximately 28% of global market revenue. Consumers' preference for eco-conscious products and rapid adoption of innovative surfactants bolster the region’s market strength. Notable companies such as Stepan Company and BASF SE maintain strong footholds here, supported by active investments in R&D.

Asia Pacific Anionic Surfactants Market Analysis and Trends

The Asia Pacific exhibits the fastest growth with a CAGR surpassing 7%. Factors fueling this growth include increasing industrialization, expanding personal care and cleaning product markets, and supportive government policies in China and India. The availability of raw materials and a growing domestic consumer base substantially contribute to market expansion. Major market players expanding capacity include Kao Corporation and Galaxy Surfactants, spurring competitive growth.

Anionic Surfactants Market Outlook for Key Countries

USA Anionic Surfactants Market Analysis and Trends

The USA’s market size and business growth remain substantial due to stringent regulations promoting green surfactants and a mature consumer base. The country leads in the adoption of sulfate-free and biodegradable surfactants, contributing nearly 10% market revenue growth in 2024. Major players like Stepan Company and Dow Chemical have accelerated specialty surfactant launches aligned with environmental mandates, reinforcing America’s industry leadership

India Anionic Surfactants Market Analysis and Trends

India's market experiences rapid expansion fueled by industrial growth and rising disposable incomes. The regulatory push for eco-friendly cleaning agents and increasing exports has driven local production capacity by approximately 15% in 2024. Companies like Galaxy Surfactants and Asianet Pakistan Pvt Ltd are capitalizing on this momentum with innovative bio-based formulations, positioning India as a pivotal growth hub within the Asia Pacific.

Analyst Opinion

Anionic surfactants production capacity has expanded significantly due to technological advancements and facility augmentations observed in Asia Pacific in 2024, with China alone increasing capacity by 12% to meet exports rising by over 15% year-over-year. This expansion is critical to sustaining the rising global market share and industry size.

Pricing trends demonstrate a moderate increase in raw material costs, especially fatty alcohol and petrochemicals, impacting overall product pricing by approximately 8% between 2023 and 2024, influencing profit margins across market players. Meanwhile, demand-side pricing elasticity remains moderate in personal care segments due to product differentiation.

The diversified end-use across household detergents, industrial cleaning, and personal care continues to fuel demand; in 2024, household segment consumption witnessed a 7% increase, driven by enhanced cleaning efficacy requirements and pandemic-induced hygiene awareness. Industrial sectors, including oilfield chemicals, also report robust growth rates for specific anionic surfactants.

Micro-segmentation data reveal a growing preference for sodium lauryl ether sulfate (SLES), dominating with a market share of 46% in 2026, attributed to its balance of performance and cost-efficiency, favored in cosmetic and detergent formulations globally, especially in North America and Asia Pacific markets.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2026: | USD 18.7 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2026 To 2033 |

| Forecast Period 2026 to 2033 CAGR: | 6.5% | 2033 Value Projection: | USD 29.3 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | Stepan Company, BASF SE, Kao Corporation, Evonik Industries AG, Solvay S.A., Clariant AG, Huntsman Corporation, Croda International Plc, Akzo Nobel N.V., Seppic S.A. | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Anionic Surfactants Market Growth Factors

Several factors are pivotal in driving the anionic surfactants market growth. Firstly, the increasing adoption of eco-friendly and bio-based surfactants, supported by rising consumer environmental awareness and regulatory incentives in markets like the U.S. and EU, accelerates business growth. Secondly, the expanding applications in personal care products, especially with the rising demand for sulfate-free alternatives, fuel growth strategies. Thirdly, burgeoning industrial cleaning sectors in emerging economies contribute significantly, as infrastructure development in India and Southeast Asia increased surfactant consumption by nearly 9% in 2024. Finally, innovations aimed at reducing skin irritation while enhancing performance are driving product demand, reflecting evolving market dynamics and consumer preferences.

Anionic Surfactants Market Development

In June 2024, Kaffe Bueno launched upcycled anionic surfactants derived from spent coffee grounds, targeting eco-friendly skin and hair care formulations. The innovation valorizes coffee waste streams and supports circular bioeconomy principles by converting by-products into high-performance cosmetic ingredients with reduced environmental footprint and improved sustainability credentials.

In March 2022, BASF launched Plantapon® Soy, a mild, bio-based anionic surfactant derived from soy protein and coconut oil. Developed for gentle rinse-off products such as shampoos and body washes, the ingredient offers excellent skin compatibility while supporting renewable feedstocks and BASF’s sustainable personal care ingredient portfolio.

Key Players

Leading Companies of the Market

Stepan Company

BASF SE

Kao Corporation

Evonik Industries AG

Solvay S.A.

Clariant AG

Huntsman Corporation

Croda International Plc

Akzo Nobel N.V.

Seppic S.A.

Several market companies have aggressively adopted innovation-driven growth strategies, such as Stepan Company’s 2024 investment in bio-based surfactant R&D, leading to a 10% improvement in product biodegradability. BASF’s strategic acquisition of specialty surfactant manufacturers expanded its market share by 8% in Europe. Kao Corporation leveraged digital marketing and formulation partnerships to enhance brand presence in the Asia Pacific, significantly increasing its market revenue

Anionic Surfactants Market Future Outlook

The future of the anionic surfactants market will be shaped by sustainable development goals, consumer preferences for green cleaning products, and increasing industrial applications. Biodegradable and bio-based anionic surfactants derived from renewable feedstocks such as plant oils and sugars will gain prominence as formulators seek to reduce environmental impact without compromising performance. Growth in emerging economies with rising standards of living will support expanded adoption across household and institutional cleaning segments. Technological innovation will focus on enhancing performance in cold-water wash systems, improving skin compatibility for personal care applications, and integrating with smart cleaning systems in industrial contexts. Furthermore, circular economy mandates and wastewater treatment improvements will drive industry collaboration to ensure product efficacy aligns with environmental stewardship.

Anionic Surfactants Market Historical Analysis

The anionic surfactants market developed as the cleaning and detergency industry matured in the early to mid-20th century, coinciding with the rise of synthetic detergents. Anionic surfactants—characterized by their negatively charged hydrophilic head groups—offered superior cleaning power, foaming properties, and emulsification performance compared to traditional soaps, particularly in hard-water conditions. Standard chemistries such as linear alkylbenzene sulfonates (LAS) and alkyl sulfates became dominant in household laundry detergents, dishwashing liquids, and industrial cleaners. Over the decades, chemical engineering advancements improved production processes, reduced undesirable branched-chain surfactants, and enhanced biodegradability features in response to environmental concerns.

Sources

Primary Research Interviews:

Detergent Manufacturers

Chemical Process Engineers

Formulation Scientists

FMCG Procurement Heads

Distributors

Databases:

ICIS Pricing Database

OECD Industry Data

Magazines:

Chemical Engineering

Household & Personal Care Today

Detergent Industry Magazine

SpecialChem

Chemical Today

Journals:

Journal of Surfactants and Detergents

Colloids and Surfaces Journal

Industrial Chemistry Journal

Applied Surface Science

Tenside Surfactants Journal

Newspapers:

Financial Times (Chemicals)

Reuters Industry News

Economic Times

The Hindu BusinessLine

Bloomberg Markets

Associations:

International Association for Soaps and Detergents

American Cleaning Institute

European Chemical Industry Council

Indian Surfactant Association

Cosmetics Europe

Share

Share

About Author

Yash Doshi is a Senior Management Consultant. He has 12+ years of experience in conducting research and handling consulting projects across verticals in APAC, EMEA, and the Americas.

He brings strong acumen in helping chemical companies navigate complex challenges and identify growth opportunities. He has deep expertise across the chemicals value chain, including commodity, specialty and fine chemicals, plastics and polymers, and petrochemicals. Yash is a sought-after speaker at industry conferences and contributes to various publications on topics related commodity, specialty and fine chemicals, plastics and polymers, and petrochemicals.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients