Ammonium Thiosulphate Fertilizer Market Size and Forecast – 2025 – 2032

The Global Ammonium Thiosulphate Fertilizer Market size is estimated to be valued at USD 1.12 billion in 2025 and is expected to reach USD 1.84 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 7.2% from 2025 to 2032.

Global Ammonium Thiosulphate Fertilizer Market Overview

Ammonium thiosulphate fertilizer is a widely used liquid nutrient blend that supplies both nitrogen and sulfur—two key macronutrients required for crop development. ATS is typically applied through drip irrigation, fertigation systems, foliar sprays, or direct soil injection, making it suitable for precision agriculture. The product enhances nitrogen uptake efficiency, prevents sulfur deficiencies in crops, and reduces nutrient volatilization when blended with urea-based fertilizers. It is extensively used for corn, wheat, cotton, oilseeds, and specialty crops due to its compatibility with liquid fertilizer systems.

Key Takeaways

The fertilizer application segment, particularly soil application, dominates the market share with a steady CAGR driven by traditional and precision farming verification.

Horticulture applications present a rapidly growing subsegment propelled by increased high-value crop cultivation globally.

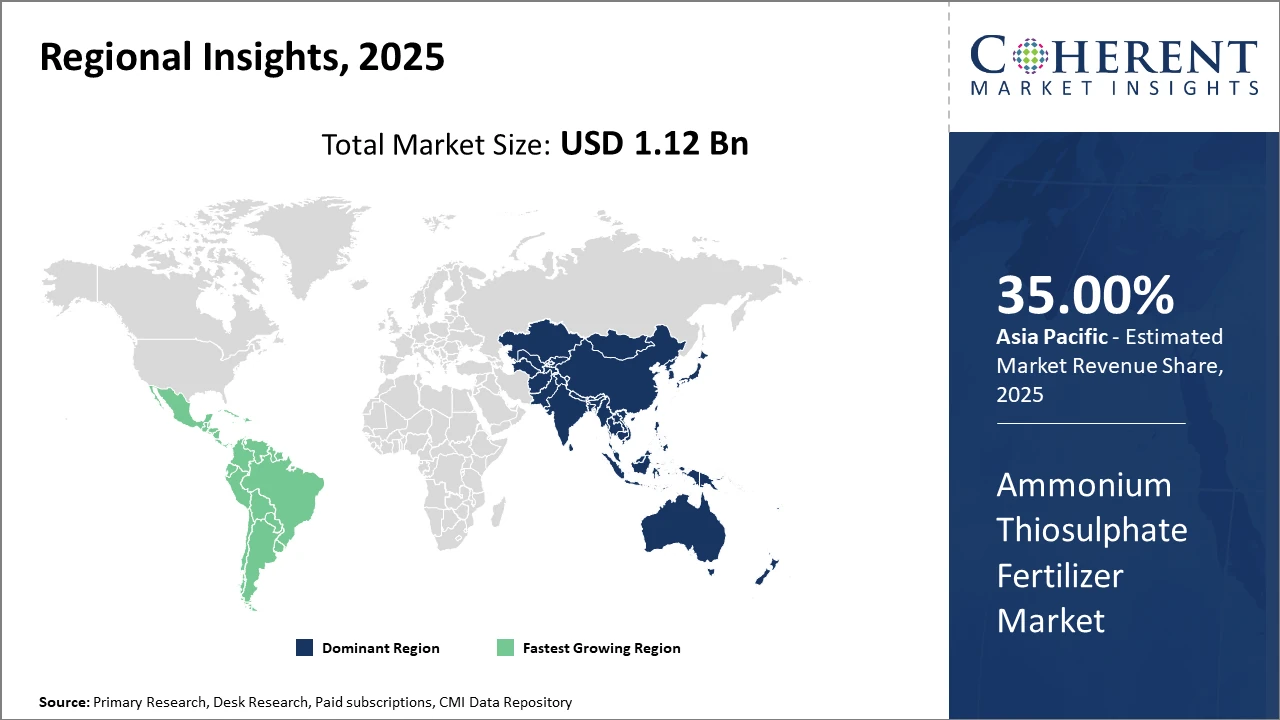

Asia Pacific holds over 35% market revenue share, fueled by expanding agricultural land use and government focus on soil nutrient management in countries like India and China.

Meanwhile, North America offers substantial business growth potential due to advanced farming infrastructure and strong R&D in fertilizer innovation.

Ammonium Thiosulphate Fertilizer Market Segmentation Analysis

To learn more about this report, Download Free Sample

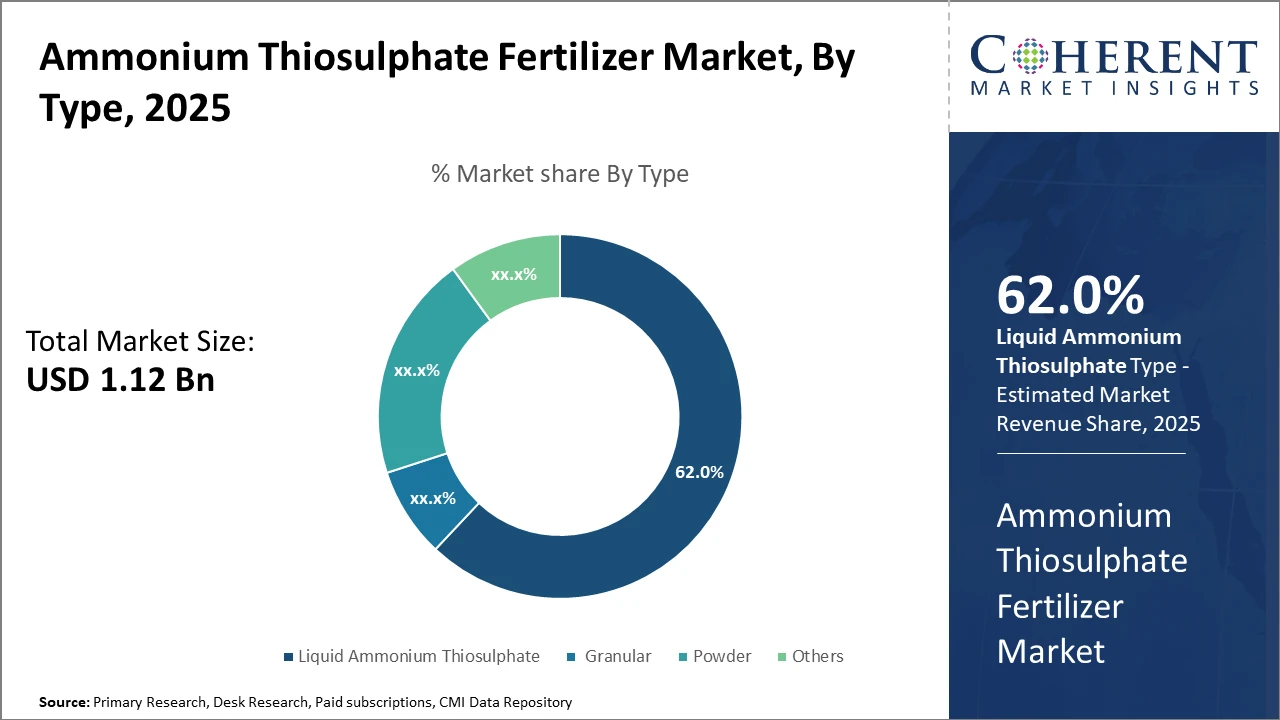

Ammonium Thiosulphate Fertilizer Market Insights, By Type

Liquid Ammonium Thiosulphate dominates the market share with 62%. This dominance is attributed to its superior solubility and compatibility with fertigation systems, which have seen widespread adoption across advanced agricultural setups. The fastest growing subsegment is Granular, driven by user preference for ease of transport and storage, especially in emerging markets. Powdered forms and other specialty grades hold smaller shares, catering primarily to niche applications and custom fertilizer blends. Liquid Ammonium Thiosulphate offers rapid nutrient availability and is preferred for precision farming, while Granular allows better handling and slower release, suiting traditional soil application.

Ammonium Thiosulphate Fertilizer Market Insights, By Application

Soil Application is dominating at 68% market share due to its extensive use in staple crop production systems. Traditional soil-applied ammonium thiosulphate ensures direct nutrient availability in root zones, making it suitable for large-scale cereal and grain cultivation globally. Fertigation is the fastest growing subsegment, spurred by increasing adoption of drip and sprinkler irrigation systems, which allow precise nutrient dosing and reduce environmental losses. Foliar feeding represents a smaller yet steady segment, primarily in high-value crops requiring rapid nutrient absorption, and others include controlled release and specialty applications targeting specific deficiencies.

Ammonium Thiosulphate Fertilizer Market Insights, By Crop Type

Cereals & Grains lead the market share given their vast cultivation area and nutrient requirements suited for ammonium thiosulphate. This segment benefits from high sulfur depletion risks in typical cereal-producing soils, necessitating targeted sulfur supplementation. Pulses & Oilseeds form a stable subsegment with growing fertilizer demand to enhance nitrogen fixation efficiency and seed quality. Horticulture, however, is the fastest growing subsegment, buoyed by expanding high-value vegetable and fruit cultivation where nutrient management precision is critical. Others include fodder crops and plantation crops, which hold minor shares.

Ammonium Thiosulphate Fertilizer Market Trends

The ammonium thiosulphate fertilizer market trend emphasizes enhanced efficiency and eco-conscious product innovation.

Notably, the demand for liquid ammonium thiosulphate formulations has surged, supported by advancements in fertigation systems, which offer uniform nutrient distribution and reduce environmental waste.

For example, data from the U.S. agricultural sector in 2024 shows a 9% uptick in adoption rates of such formulations, contributing to improved fertilization outcomes.

There is also a growing movement toward integrating ammonium thiosulphate with micronutrient blends, which addresses multi-nutrient deficiencies simultaneously, fostering sustainable farming practices.

Additionally, increased digitalization in agriculture, such as precision nutrient mapping and automated fertigation scheduling, is shifting market dynamics by enabling optimized resource use and boosting crop yields.

Ammonium Thiosulphate Fertilizer Market Insights, By Geography

To learn more about this report, Download Free Sample

Asia Pacific Ammonium Thiosulphate Fertilizer Market Analysis and Trends

In Asia Pacific, the ammonium thiosulphate fertilizer market dominates with a 35% industry share, propelled by the vast agricultural base and proactive government policies encouraging nutrient input optimization. Countries like India and China have deployed subsidy schemes promoting balanced fertilization, resulting in large-scale adoption. Significant local manufacturers and multinational market companies have also set up extensive distribution networks in this region, supporting robust market penetration.

Latin America Ammonium Thiosulphate Fertilizer Market Analysis and Trends

Meanwhile, Latin America exhibits the fastest growth with a CAGR surpassing 8%, underpinned by increasing export-oriented farming, infrastructural improvements, and favorable trade dynamics. Brazil and Argentina spearhead this growth, supported by the scaling of precision agriculture and stronger integration of ammonium thiosulphate in fertigation methods. Strategic collaborations between market companies and local agricultural cooperatives enhance product accessibility and foster rapid business growth.

Ammonium Thiosulphate Fertilizer Market Outlook for Key Countries

USA Ammonium Thiosulphate Fertilizer Market Analysis and Trends

The USA remains a significant contributor to the ammonium thiosulphate fertilizer market, with advanced agricultural infrastructure and high adoption of precision farming driving demand. The country’s emphasis on sustainable agriculture through regulatory frameworks and fertilizer efficiency programs in 2025 spurred a 7% increase in ammonium thiosulphate consumption. Key players such as Koch Fertilizer LLC have expanded liquid fertilizer blending capacities to address growing market needs. Furthermore, collaborations with agritech firms have enhanced data-driven nutrient management, strengthening market growth strategies and competitive positioning.

Brazil Ammonium Thiosulphate Fertilizer Market Analysis and Trends

Brazil’s market is fueled by extensive soybean and maize cultivation, making it a critical user of ammonium thiosulphate fertilizers. Investments in fertigation infrastructure and government support for balanced fertilization practices led to a 10% growth in market revenue in 2024. Local players and multinational market companies have intensified their presence, focusing on customized formulations catering to regional soil profiles. The development of export-oriented cropping systems further accentuates Brazil’s strategic importance within the Latin American market segment.

Analyst Opinion

Supply-Side Optimization Driving Market Revenue: Production capacities for ammonium thiosulphate have increased by approximately 8% year-over-year as manufacturers invest heavily in modernizing facilities to ensure product consistency and reduce impurities. For instance, advancements in synthesis techniques in 2024 enabled cost-efficient scaling, contributing to a 6% reduction in production costs, thereby supporting competitive pricing structures that stimulate market growth.

Demand-Side Dynamics: The rising adoption of ammonium thiosulphate in foliar feeding and fertigation applications within precision agriculture has led to a surge in demand, especially in developing agricultural economies. Data from 2025 indicates a 12% year-on-year increase in imports of ammonium thiosulphate in countries like India and Brazil, driven by government initiatives promoting micro-nutrient-rich fertilizers to enhance soil health.

Sectoral Use Cases Highlight Market Potential: The fertilizer’s effectiveness in mitigating sulfur deficiency and enhancing nitrogen efficiency has elevated its utilization across cereals, pulses, and horticulture. Field trials conducted in 2024 revealed a yield improvement of up to 15% in maize and cotton crops treated with ammonium thiosulphate compared to conventional fertilizers, supporting strong business growth projections.

Pricing Trends and Market Challenges: Price volatility in raw sulfur and ammonia feedstocks in 2025 impacted market revenues, with an average price increase of 5.5% influencing end-user pricing. Despite this, manufacturers leveraged long-term supply contracts and regional production hubs to mitigate network bottlenecks and deliver consistent supply, bolstering market stability and confidence among stakeholders.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2025: |

USD 1.12 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 7.2% | 2032 Value Projection: |

USD 1.84 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | DAPCO Industries, Meghmani Organics, OCP Group, UPL Limited, LG Chem, Toros Tarim, EuroChem Group AG, Fenchem Biotek Pvt Ltd., Arkema S.A., FMC Corporation. | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Ammonium Thiosulphate Fertilizer Market Growth Factors

The growing emphasis on crop nutrition management and the reduction of sulfur depletion in soils remain core drivers of market growth. Government subsidies and regulatory incentives promoting the use of balanced fertilizers have triggered increased adoption, especially in emerging economies such as India and Brazil. Additionally, the integration of ammonium thiosulphate with advanced irrigation methods has propelled its use in precision agriculture, contributing to enhanced nutrient uptake and crop productivity. The increasing prevalence of nutrient deficiencies in staple crops has reinforced the fertilizer’s demand, supported by field data from 2024 indicating yield improvements exceeding 14% in sulfur-deficient fields treated with targeted applications. Moreover, rising investments in fertilizer infrastructure, particularly in Asia Pacific, further accelerate market revenue generation.

Ammonium Thiosulphate Fertilizer Market Development

In January 2023, Tessenderlo Kerley International acquired the marketing and sales operations for ATS fertilizers produced by Esseco Srl in Italy. This strategic move strengthens its Thio-Sul® portfolio, enhances production and distribution efficiency, and improves customer service across European agricultural markets.

In 2025, Jubilant Agri recently launched its new “Ammonium Phosphate Sulphate” fertilizer for the Indian market. The product is designed to improve balanced crop nutrition with a combined phosphate–nitrogen profile and added Sulphur, supporting higher yields in cereals, oilseeds, and pulses.

Key Players

Leading Companies of the Market

DAPCO Industries

Meghmani Organics

OCP Group

UPL Limited

LG Chem

Toros Tarim

EuroChem Group AG

Fenchem Biotek Pvt Ltd.

Arkema S.A.

FMC Corporation

Several key market companies have pursued aggressive growth strategies through strategic partnerships and capacity expansion. For example, Nutrien Ltd. entered into joint ventures with regional distributors in 2024 to expand its supply chain network across Asia Pacific, resulting in a 10% rise in sales revenue. Meanwhile, Yara International ASA leveraged investments in digital agronomy services to complement its ammonium thiosulphate offerings, enhancing customer retention and market share significantly during the same period.

Ammonium Thiosulphate Fertilizer Market Future Outlook

In the future, the ATS market will benefit from rising global demand for high-efficiency fertilizers, especially as farmers confront stricter nutrient-loss regulations. Increasing focus on improving soil health, optimizing nitrogen use efficiency, and deploying precision fertilizer application will drive broader adoption of ATS-based blends. Technological advancements in controlled-release and sensor-based fertilizer application will integrate ATS more deeply into smart farming systems. Developing markets in South America, Southeast Asia, and Africa are expected to accelerate consumption as irrigation systems modernize. Sustainability trends and pressure to minimize nitrogen runoff may also make ATS a key component in next-generation fertilizer formulations, particularly in regions adopting 4R nutrient stewardship policies.

Ammonium Thiosulphate Fertilizer Market Historical Analysis

Historically, ammonium thiosulphate fertilizer gained traction as farmers recognized the importance of sulfur as an essential nutrient in crop metabolism and protein synthesis. As sulfur deficiencies increased due to reduced atmospheric deposition and intensified cropping, ATS became a preferred liquid sulfur source due to its compatibility with nitrogen fertilizers like UAN solutions. Over the last 15 years, it was increasingly integrated into precision agriculture, fed through drip irrigation, pivot systems, and soil injection in grain, oilseed, and specialty crop farming. The market expanded with rising adoption in the U.S., Australia, and parts of Europe, supported by improved agronomic research demonstrating the role of ATS in mitigating nitrogen volatilization and enhancing plant nutrient uptake. Industry consolidation and improved supply-chain flexibility further strengthened its position as a reliable liquid fertilizer component.

Sources

Primary Research Interviews:

Agronomists

Fertilizer Distributors

Soil Scientists

Crop Consultants

Agricultural Co-op Managers

Databases:

USDA Fertilizer Reports

FAOSTAT Agriculture Data

Statista Fertilizer Market Reports

World Bank Agriculture Indicators

UN Comtrade Chemical Fertilizers

Magazines:

CropLife

Fertilizer Internationa

AgriBusiness Global

Farm Journal

AgroPages

Journals:

Journal of Plant Nutrition

Agronomy Journal

Soil Science Society Journal

Journal of Agricultural Scienc

Crop Science Journal

Newspapers:

The Hindu Business Line (Agri)

Financial Times (Commodities)

The Guardian (Environment)

Reuters Agriculture

The Wall Street Journal (Commodities)

Associations:

International Fertilizer Association

Fertilizer Institute

American Society of Agronomy

CropLife America

National Association of Agricultural Educators

Share

Share

About Author

Yash Doshi is a Senior Management Consultant. He has 12+ years of experience in conducting research and handling consulting projects across verticals in APAC, EMEA, and the Americas.

He brings strong acumen in helping chemical companies navigate complex challenges and identify growth opportunities. He has deep expertise across the chemicals value chain, including commodity, specialty and fine chemicals, plastics and polymers, and petrochemicals. Yash is a sought-after speaker at industry conferences and contributes to various publications on topics related commodity, specialty and fine chemicals, plastics and polymers, and petrochemicals.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients