Adiponitrile Market Size and Forecast – 2025 – 2032

The Global Adiponitrile Market size is estimated to be valued at USD 6.5 billion in 2025 and is expected to reach USD 10.3 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 7.3% from 2025 to 2032.

Global Adiponitrile Market Overview

Adiponitrile is a colorless liquid organic compound featuring two nitrile groups, serving as a key intermediate in the production of hexamethylenediamine (HMD), which is essential for nylon-6,6 fiber and engineering plastics. Its chemical stability, reactivity with amines, and high purity requirements make it ideal for large-scale polymer synthesis. Beyond nylon production, adiponitrile finds application in coatings, adhesives, and polyurethane formulations, providing flexibility, strength, and chemical resistance. Industrial production relies on controlled hydrogenation of acrylonitrile or electrochemical processes to achieve high yields of high-purity adiponitrile.

Key Takeaways

Nylon 6,6 Production remains the dominant application segment in the market, capturing approximately 67% market share due to its extensive use in automotive and textile industries.

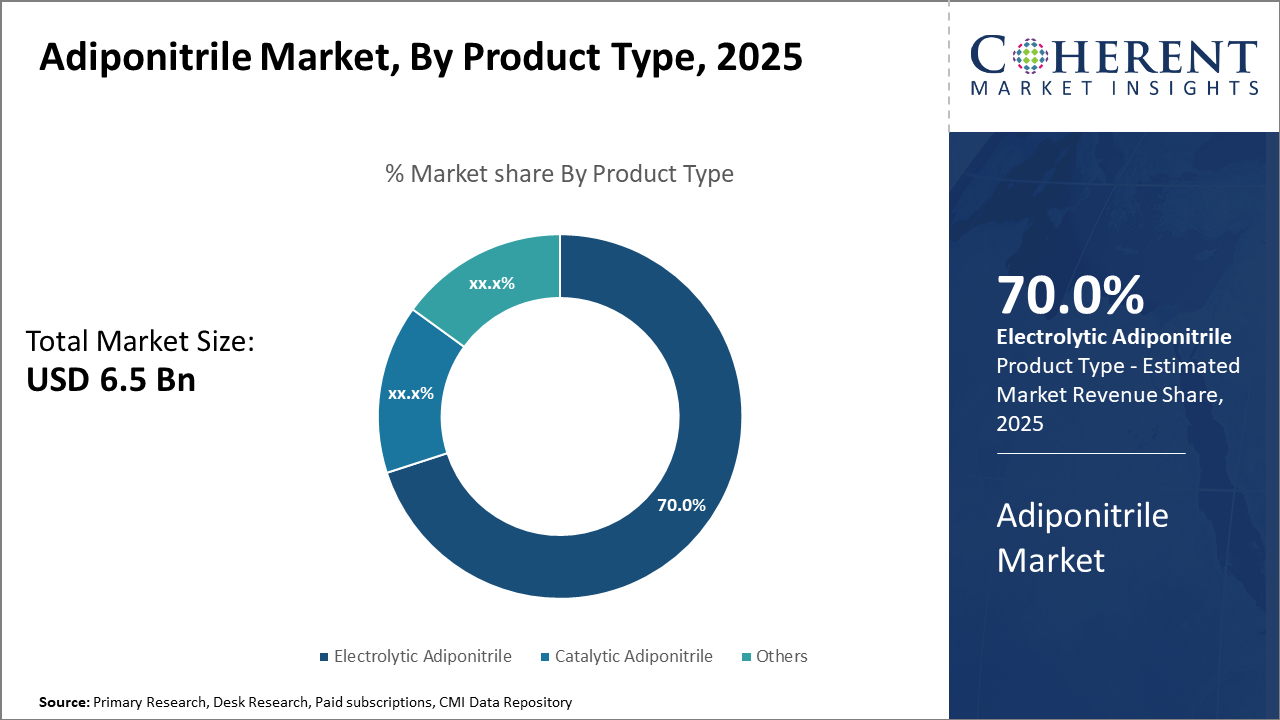

Electrolytic Adiponitrile leads product types with a 70% share, owing to its cost-efficiency and scalability in production.

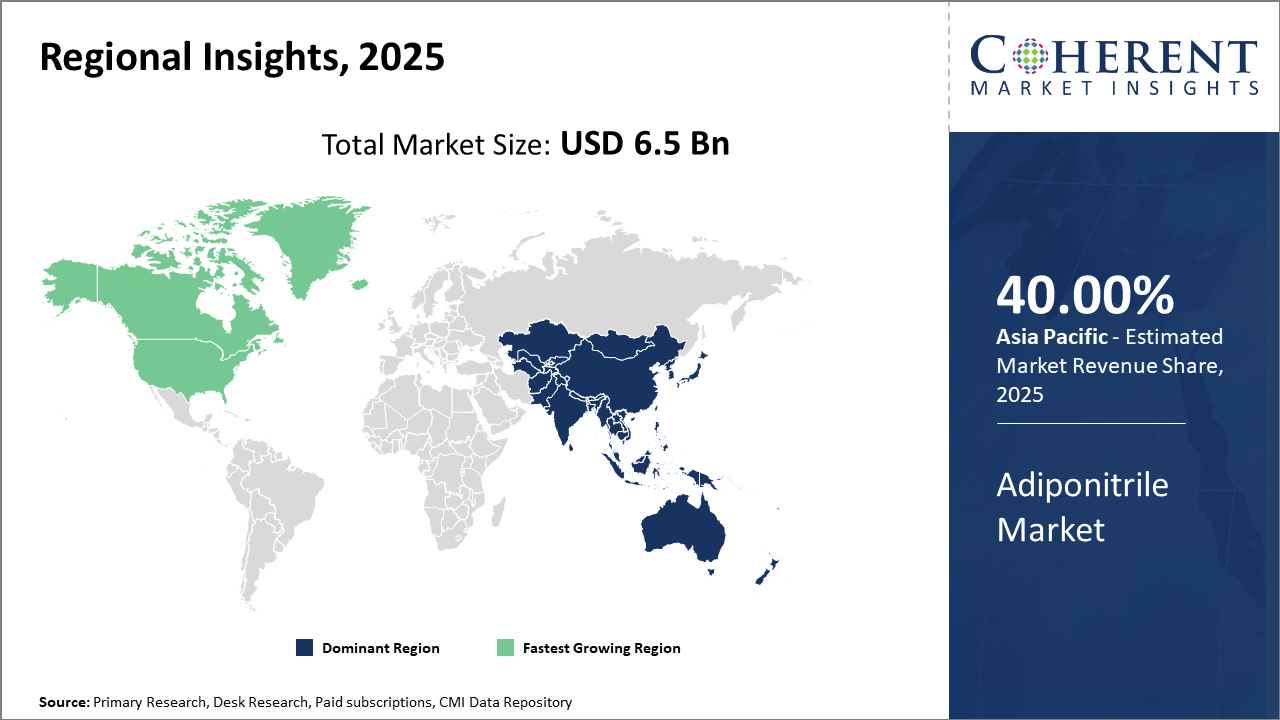

Asia Pacific retains the largest market share of over 40%, driven by China's extensive industrial base and growing investment in synthetic fiber manufacturing facilities.

North America, led by the USA, exhibits a steady CAGR of 6.8%, fueled by innovations in lightweight automotive components and diversified end-use applications.

Adiponitrile Market Segmentation Analysis

To learn more about this report, Download Free Sample

Adiponitrile Market Insights, By Product Type

Electrolytic Adiponitrile dominates the market share due to its cost-effectiveness and scalability in manufacturing. This segment has the highest industrial uptake, supported by advancements in electrochemical synthesis technology, leading to enhanced production yields. The fastest-growing subsegment, Catalytic Adiponitrile, is gaining traction driven by improvements in catalyst efficiency and environmental considerations, making it a preferred option in regions with stringent emission norms. Others include specialty and custom production processes, which support niche applications but hold comparatively minor shares. Electrolytic Adiponitrile benefits from established supply chains and widespread industrial acceptance, whereas

Adiponitrile Market Insights, By Application

Nylon 6,6 Production dominates the market share as the primary end-use, accounting for approximately two-thirds of total demand due to vast use in the textile and automotive industries. This segment’s growth is driven by the consistent rise in synthetic fiber consumption and automotive lightweight components manufacturing. The fastest-growing subsegment is Adhesives, fueled by expanding industrial and construction sectors seeking high-performance bonding agents with enhanced durability. Synthetic Resins continue to hold a considerable portion of the market, supporting applications in engineering plastics and packaging, while Others include niche uses such as specialty films and elastomers with incremental growth potential.

Adiponitrile Market Insights, By Production

Electrolysis Method dominates the market share due to its high efficiency and widespread adoption in the Asia Pacific and North America. The technology has been bolstered by innovations that reduce energy consumption and improve yield quality. Catalytic Hydrogenation is the fastest-growing subsegment, as advances in catalyst design minimize environmental impact and enable small-scale, flexible production units, appealing to markets with stringent eco-regulations.

Adiponitrile Market Trends

The market trends illustrate a pronounced movement toward sustainable and energy-efficient production processes.

The increased adoption of renewable energy-based electrolysis has reduced the carbon footprint by an estimated 18% in leading production sites by 2025.

Additionally, regional trade realignments, such as preferential trade agreements between Middle Eastern exporters and European buyers, have reshaped supply chains, enhancing market scope and revenue inflows for emerging exporters.

The integration of digitalized process controls in production is also gaining traction to boost operational efficiency.

Adiponitrile Market Insights, By Geography

To learn more about this report, Download Free Sample

Asia Pacific Adiponitrile Market Analysis and Trends

Asia Pacific commands the largest market share of approximately 40%, attributed to China’s massive industrial ecosystem and investments in chemical production infrastructure. The region benefits from supportive government policies promoting industrial growth and export facilitation, making it the epicenter for adiponitrile business growth in the near term.

North America Adiponitrile Market Analysis and Trends

North America exhibits the fastest CAGR of around 6.8%, largely due to advancements in automotive lightweight materials and innovation-led usage expansion. The USA, in particular, is investing heavily in advanced polymers and sustainable production, with manufacturers like Invista driving market revenue through novel product introductions and alliance formations.

Adiponitrile Market Outlook for Key Countries

USA Adiponitrile Market Analysis and Trends

The USA’s market is characterized by high technological maturity and innovation adoption. Leading companies such as Invista and Ascend Performance Materials have increased R&D investments, focusing on advanced catalysts and green synthesis routes. The country’s stringent environmental regulations have pushed production toward cleaner processes, enhancing sustainable business growth and market dynamics. The automotive sector remains a substantial consumer base, stimulated by federal initiatives for fuel efficiency, which accounts for a significant portion of market revenue.

China Adiponitrile Market Analysis and Trends

China dominates the Asia Pacific market landscape, buoyed by expansive chemical manufacturing facilities and strong governmental support for industrial upgrades. Major players such as Sinopec have ramped up capacity using advanced electrolysis technology, cementing its market share dominance. The robust demand from the textile industry, combined with growing exports to neighboring regions, fuels continued business growth and strengthens the country’s standing as a global production hub.

Analyst Opinion

One critical driver shaping adiponitrile market growth is the expansion in nylon 6,6 production capacity worldwide. In 2024 alone, several integrated petrochemical complexes expanded their production lines for adiponitrile, resulting in a 6% growth in global supply capacity. For instance, a major petrochemical manufacturer in Asia increased adiponitrile output by 120 kilotons annually, capitalizing on rising demand for high-performance fibers, directly impacting market revenue and market size.

Pricing volatility of raw materials, particularly butadiene and hydrogen cyanide, remains a pivotal supply-side factor influencing the adiponitrile market share. In 2025, fluctuations in crude oil prices caused a 12% variation in feedstock cost, affecting EBITDA margins for producers but also incentivizing technological innovation in alternative synthesis methods. This dynamic supply scenario underlines the complexity of market dynamics and price sensitivity within industry trends.

Import-export patterns have evolved significantly, with emerging economies in the Asia Pacific and Middle East increasingly becoming export hubs. Data from 2024 highlights a 15% increase in adiponitrile exports from the Middle East to Europe, marking a geographic shift in market scope and emphasizing the growing role of regional trade agreements in shaping market growth strategies.

Demand-side indicators reveal diversified end-use sectors although nylon 6,6 applications dominate. For instance, automotive component manufacturing accounted for an estimated 40% of adiponitrile consumption in 2025 due to enhanced demand for lightweight, durable materials. Increased investments in electric vehicle production lines in North America and Asia further propel usage, feeding directly into market analysis forecasts for upcoming years.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2025: |

USD 6.5 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 7.3% | 2032 Value Projection: |

USD 10.3 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | SABIC, Sumitomo Chemical, Evonik Industries AG, Ube Industries, Hanwha Chemical, LyondellBasell Industries, Adiponitrile Technologies Ltd., Mitsui Chemicals, Toray Industries, Qilu Petrochemical | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Adiponitrile Market Growth Factors

The burgeoning demand for nylon 6,6 in the automotive and textile industries is a primary market driver, with the segment accounting for over 65% of the total adiponitrile market revenue in 2025. Rising urbanization and increased disposable incomes in emerging economies intensify demand for synthetic fibers and engineering plastics. Additionally, governmental focus on lightweight vehicle components to improve fuel efficiency has stimulated automotive applications, bolstering market revenue figures. Innovations in catalytic processes, improving yield and sustainability of adiponitrile synthesis, further propel the market’s growth trajectory. Lastly, ongoing infrastructure investments in the Asia Pacific region stimulate regional business growth and market share.

Adiponitrile Market Development

In March 2024, Invista introduced a next-generation adiponitrile (ADN) production technology at its France facility, engineered to substantially increase output capacity while improving overall process stability. The new platform integrates high-efficiency catalytic systems and advanced heat-recovery pathways, enabling a meaningful reduction in both energy consumption and greenhouse gas emissions across the ADN manufacturing chain. This modernization allows Invista to strengthen supply reliability for nylon 6,6 value-chain partners while supporting the broader industry shift toward lower-carbon intermediates.

In June 2024, BASF launched a new sustainable adiponitrile production process designed to significantly lower carbon emissions compared with conventional manufacturing routes, incorporating optimized feedstock utilization, improved catalytic selectivity, and advanced emissions-control integration. The process forms part of BASF’s long-term decarbonization program and enables downstream producers—particularly nylon, automotive, and performance material manufacturers—to access ADN with a reduced environmental footprint. The technology also enhances production resilience, offering greater efficiency and flexibility across global supply networks.

Key Players

Leading Companies of the Market

SABIC

Sumitomo Chemical

Evonik Industries AG

Ube Industries

Hanwha Chemical

LyondellBasell Industries

Adiponitrile Technologies Ltd.

Mitsui Chemicals

Toray Industries

Qilu Petrochemical

Leading companies have adopted aggressive market growth strategies such as capacity expansion, technology licensing, and strategic partnerships. For example, Sinopec’s collaboration with advanced electrolysis technology developers in 2024 led to a 25% increase in production efficiency, enhancing their global market share. Similarly, BASF’s integration of sustainable manufacturing practices significantly reduced operating expenses, reinforcing their competitive positioning and revenue growth within the adiponitrile market.

Adiponitrile Market Future Outlook

The market is expected to grow alongside increasing demand for nylon-6,6 fibers and engineering plastics. Industrial adoption in automotive lightweighting, high-performance textiles, and industrial coatings will drive further consumption. Emerging economies with expanding manufacturing and textile sectors will be key contributors. Advances in green and energy-efficient production technologies may enhance sustainability, reduce costs, and strengthen market competitiveness.

Adiponitrile Market Historical Analysis

Adiponitrile, a key intermediate for hexamethylenediamine and nylon-6,6 production, historically underpinned the synthetic fiber and polymer industries. Its high chemical purity and stability were critical for producing high-strength fibers, engineering plastics, and industrial coatings. Major production advancements—such as electrochemical and catalytic hydrogenation processes—enabled large-scale output, supporting global demand for nylon in automotive, textile, and packaging applications.

Sources

Primary Research Interviews:

Nylon Manufacturers

Polymer Engineers

Chemical Plant Managers

Databases:

IHS Markit Chemical Economics

UN Comtrade Trade Data

Magazines:

Chemical Week

Plastics Technology

Industrial Chemistry News

Journals:

Journal of Polymer Science

Industrial & Engineering Chemistry Research

Macromolecular Chemistry and Physics

Newspapers:

The Economic Times (Chemicals)

Bloomberg (Industry)

Financial Times (Petrochemicals)

Associations:

American Chemistry Council (ACC)

European Chemical Industry Council (CEFIC)

Society of Chemical Industry (SCI)

Share

Share

About Author

Vidyesh Swar is a seasoned Consultant with a diverse background in market research and business consulting. With over 6 years of experience, Vidyesh has established a strong reputation for his proficiency in market estimations, supplier landscape analysis, and market share assessments for tailored research solution. Using his deep industry knowledge and analytical skills, he provides valuable insights and strategic recommendations, enabling clients to make informed decisions and navigate complex business landscapes.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients