Iced Tea Market Size and Forecast – 2025 – 2032

The Global Iced Tea Market size is estimated to be valued at USD 7.8 billion in 2025 and is expected to reach USD 13.5 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 8.1% from 2025 to 2032.

Global Iced Tea Market Overview

The iced tea products encompass ready-to-drink (RTD) and powdered tea beverages formulated for cold consumption, offering refreshing, low-calorie alternatives to carbonated soft drinks. Products include black, green, herbal, and fruit-flavored variants, often enriched with natural extracts, vitamins, and sweeteners such as stevia. Packaging formats range from bottles and cans to single-serve sachets and on-the-go tetra packs. Premium and organic iced tea products, featuring clean-label and antioxidant-rich ingredients, have gained significant traction.

Manufacturers are also investing in sugar-free and functional iced coffee variants that incorporate adaptogens, probiotics, or collagen to appeal to health-conscious consumers. With innovation in flavor fusion and sustainable packaging, the market is evolving toward eco-friendly, customizable beverage solutions targeting wellness-oriented demographics.

Key Takeaways

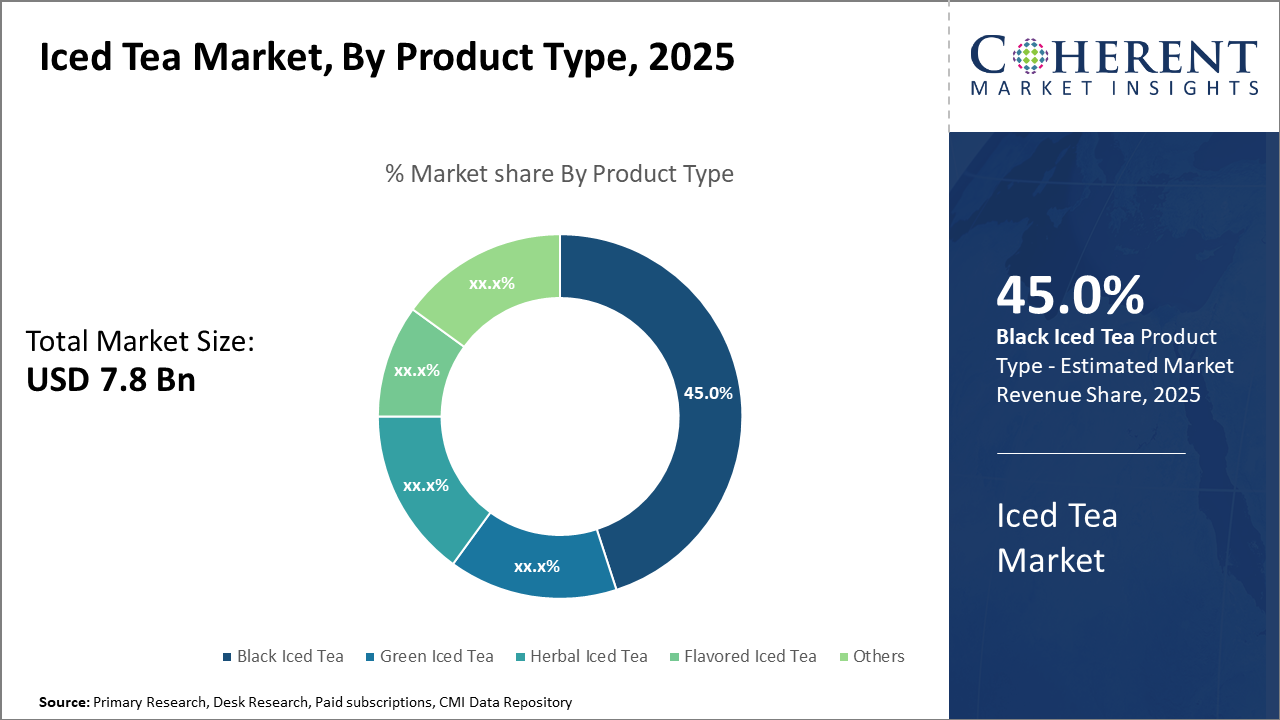

The Black Iced Tea segment maintains a commanding market share of 45%, driven by traditional taste preferences and gradual innovation in flavor variants.

Supermarkets and hypermarkets remain the leading distribution channel, commanding over 50% of the market revenue, especially in North America and Europe, where consumer footfall remains high.

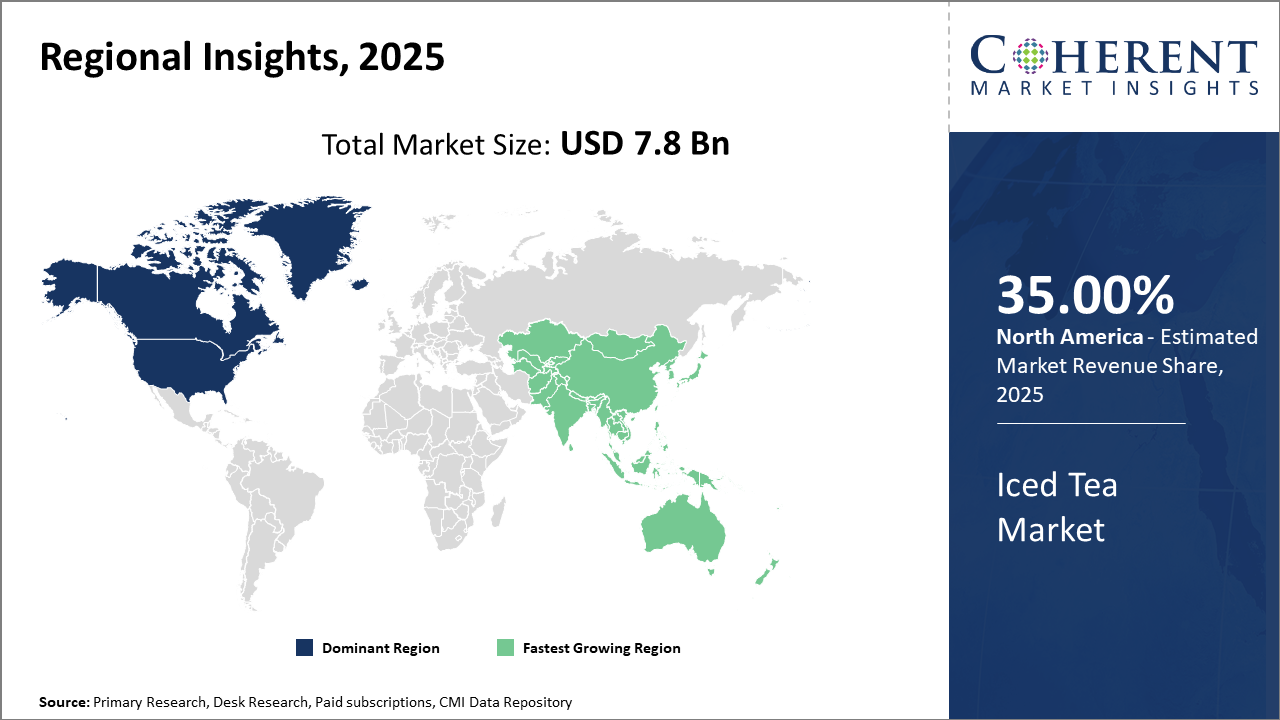

Regionally, North America dominates, contributing around 35% to the global market share, largely attributed to strong brand penetration and health-conscious consumer behavior.

Asia Pacific emerges as the fastest-growing region, with a CAGR surpassing 10%, propelled by urban population growth, rising disposable income, and expanding middle-class demographics.

Iced Tea Market Segmentation Analysis

To learn more about this report, Download Free Sample

Iced Tea Market Insights, By Product Type

Black Iced Tea commands the highest market share. Black Iced Tea’s dominance originates from its long-standing consumer base and familiarity, driving consistent demand in traditional markets such as North America and Europe. Its robust flavor profile and expanding low-sugar variants sustain industry size and revenue. The fastest-growing subsegment is Flavored Iced Tea, which addresses shifting consumer interest in innovative and health-beneficial flavors, evidenced by rapid uptake of citrus and berry infusions, marking a 12% volume growth in 2025. Green Iced Tea, prized for antioxidant benefits, holds significant niche appeal but remains secondary in market share.

Iced Tea Market Insights, By Packaging Type

PET Bottles dominate the market share. PET packaging's lightweight, durability, and cost-effectiveness contribute to its prominence, with manufacturers in 2024 reporting a 20% increase in PET bottle production aligned with market demand. Innovations also target eco-conscious consumers through recycling and biodegradable materials, reinforcing brand loyalty. The fastest-growing packaging format is Cans, gaining popularity due to portability and convenience, particularly in fast-food and vending machine channels, showing year-on-year sales growth exceeding 15%.

Iced Tea Market Insights, By Distribution Channel

Supermarkets & Hypermarkets dominate market share by enabling a wide geographic reach. Their well-established shelf presence and promotional capabilities have been pivotal to market revenue generation, especially in mature markets. Online Retail stands out as the fastest-growing channel, expanding by over 25% annually with the acceleration of e-commerce and digitization. Enhanced consumer convenience and direct-to-consumer brand engagement power this expansion.

Iced Tea Market Trends

The iced tea market is characterized by increasing consumer preference for antioxidant-rich and functional beverages, as evidenced by a 22% revenue growth in fortified iced teas in 2025 alone.

Packaging innovation focusing on sustainability is another pronounced trend, with manufacturers adopting biodegradable and recyclable materials to meet consumer environmental expectations.

The surge in e-commerce activity globally, particularly post-pandemic, has accelerated iced tea demand through online retail, which saw an unprecedented 25% increase in sales revenue in recent years.

Iced Tea Market Insights, By Geography

To learn more about this report, Download Free Sample

North America Iced Tea Market Analysis and Trends

In North America, the iced tea market dominance is supported by strong consumer health awareness, leading to sustained demand for low-sugar and organic products. This region accounts for approximately 35% of the overall market share, benefiting from established distribution infrastructure and aggressive promotional strategies from key market players like The Coca-Cola Company and PepsiCo.

Asia Pacific Iced Tea Market Analysis and Trends

Meanwhile, the Asia Pacific exhibits the fastest growth with a CAGR exceeding 10%. This acceleration stems from rapid urbanization, rising disposable incomes, and an increasing young population adopting RTD iced tea beverages. Countries such as China and India are pivotal due to expanding middle-class populations and a rising on-the-go consumption culture. Companies like Tata Global Beverages and Ito En have contributed significantly by tailoring product portfolios to regional tastes and expanding retail presence.

Iced Tea Market Outlook for Key Countries

USA Iced Tea Market Analysis and Trends

The USA's iced tea market continues to be influential worldwide, driven by evolving health-conscious consumption and diversified product launches. In 2024, approximately 40% of the RTD iced tea sales globally originated from the US market, underlining its scale and maturity. Leading companies such as The Coca-Cola Company and PepsiCo utilize extensive distribution networks and innovative marketing campaigns to maintain dominant market share. Additionally, consumer shifts toward organic and natural iced teas have prompted increased investments in product reformulation, boosting industry revenue by over 8% year-over-year.

India Iced Tea Market Analysis and Trends

India's iced tea market is rapidly expanding, fueled by young demographics and urbanization. Growth in disposable income has led to a 15% increase in iced tea consumption in metropolitan areas in 2025. Local players, alongside international entrants such as Tata Global Beverages, capitalize on regional flavor preferences and affordable pricing strategies. The growing café culture further stimulates demand, with innovative packaging enhancing convenience for on-the-go consumers. Government initiatives promoting food safety and quality standards also bolster investor confidence and market growth potential.

Analyst Opinion

Robust production capacity remains a key supply-side driver, enabling manufacturers to meet surging demand. For instance, in 2024, leading beverage producers expanded their bottling capacities by 12%, catalyzing increased distribution reach. This escalation supports higher market share capture through enhanced product availability in emerging markets.

Demand-side pricing strategies effectively influence consumption patterns. Competitive pricing coupled with premium variants has fostered a dual-tier market. Data from 2025 indicate that price elasticity favors mid-range iced tea products, contributing to a 7% volume increase in North America and Europe combined.

The rapid adoption of ready-to-drink (RTD) iced tea across on-the-go consumer segments is a crucial demand indicator. In 2024, RTD iced tea sales grew by 15% in urban Asia Pacific, driven by evolving lifestyle habits and increasing disposable incomes supporting market expansion.

Segment penetration into niche industries such as wellness and organic beverage lines has unlocked additional revenue streams. Recent launches in the US organic iced tea segment gained an 18% share in newly targeted health-conscious consumer groups as of Q2 2025.

Market Scope

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2025 | Market Size in 2025: |

USD 7.8 billion |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 8.1% | 2032 Value Projection: | USD 13.5 billion |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: | Boston Tea Trading Co., Fuze Beverage, Inc., The Coca-Cola Company, Nestlé S.A., PepsiCo, Inc., Arizona Beverage Company, Unilever PLC, Ito En, Ltd., Lucozade Ribena Suntory, Tata Global Beverages. | ||

| Growth Drivers: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Iced Tea Market Growth Factors

The rise in health-conscious consumers driving preference for natural, low-calorie beverages significantly fuels market growth, with a 15% increase in organic iced tea sales observed in North America during 2024. Rapid urbanization in the Asia Pacific encourages on-the-go purchasing, pushing RTD iced tea adoption with 20% annual growth rates in major cities. Additionally, innovative packaging formats such as eco-friendly PET bottles and recyclable cans are enhancing consumer appeal and sustainability alignment, improving brand loyalty. Expansion of online retail channels has streamlined accessibility, offering growth via e-commerce platforms, which showed a 25% jump in iced tea revenues in 2025.

Iced Tea Market Development

In May 2025, Sprite introduced “Sprite + Tea,” a limited-edition blend combining the brand’s classic lemon-lime soda with brewed black tea flavor. Available in both regular and zero-sugar varieties across the U.S. and Canada, the product taps into a viral social-media trend featuring tea-soaked soda. The launch underscores Coca-Cola’s strategy of rapid innovation and engaging younger consumers via digital insights.

In July 2022, teapigs entered the ready-to-drink (RTD) iced-tea market with two new canned varieties—Black Tea with Peach and Super Fruit—sweetened using organic agave and free from artificial flavors and sweeteners. The UK-based launch marks a significant diversification for the premium tea brand into the growing RTD segment, responding to consumer demand for “better-for-you” and premium beverage options.

Key Players

Leading Companies of the Market

Boston Tea Trading Co.

Fuze Beverage, Inc.

The Coca-Cola Company

Nestlé S.A.

PepsiCo, Inc.

Arizona Beverage Company

Unilever PLC

Ito En, Ltd.

Lucozade Ribena Suntory

Tata Global Beverages

Several leading companies have adopted aggressive market growth strategies, including expanded product diversification, innovative flavor development, and strategic mergers. For example, The Coca-Cola Company’s acquisition of smaller regional iced tea brands in 2024 bolstered its presence in Asia Pacific markets, resulting in a 10% increase in market share within targeted segments. PepsiCo’s dynamic pricing strategy in emerging markets, coupled with enhanced digital marketing campaigns, significantly increased volume sales by 14% in 2025.

Iced Tea Market Future Outlook

The future outlook for the iced tea market remains strong, with evolving consumer preferences toward wellness-oriented, natural, and functional beverages. Product innovation will center around sugar-free, plant-based, and infused varieties that cater to vegan and health-conscious consumers. Premiumization through craft blends, exotic flavors, and limited-edition releases will attract young demographics. Sustainable packaging—particularly recyclable bottles and compostable cartons—will play a key role in brand differentiation. The integration of iced tea into foodservice channels and the growth of e-commerce subscriptions for health beverages are expected to sustain demand. With increasing investments in cold-brew technology and flavor authenticity, the market will continue transitioning toward natural, experiential, and personalized beverage offerings.

Iced Tea Market Historical Analysis

The iced tea market emerged in the late 20th century as a convenient, refreshing beverage alternative to carbonated soft drinks. Initially dominated by sweetened black tea formulations in the U.S. and Japan, the category expanded rapidly with the introduction of green, herbal, and fruit-flavored variants in the early 2000s. Growing health consciousness led to a decline in sugary drinks and a surge in demand for low-calorie, antioxidant-rich beverages. Brands began emphasizing organic ingredients, sustainable sourcing, and premium packaging. The RTD (ready-to-drink) segment experienced significant growth, supported by café culture, convenience retailing, and lifestyle marketing. By the late 2010s, innovations in cold-brewing, micro-batch production, and functional iced teas with added vitamins or adaptogens further diversified the market.

Sources

Primary Research Interviews:

Beverage Product Managers

Nutrition Scientists

Retail Chain Buyers

Marketing Executives

Databases:

FAO Beverage Statistics

Others

Magazines:

Beverage Daily

Food Navigator

Tea & Coffee Trade Journal

Drinks Insight Network

Journals:

Food Chemistry

Journal of Functional Foods

Beverages Journal

Nutrition Research Reviews

Associations:

Tea Association of the USA

International Tea Committee (ITC)

Specialty Food Association

Global Beverage Association

Share

Share

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Select a License Type

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients